At what age are you planning to retire? Do you have enough saved up to do so? Two simple questions, but the answers are not so simple

For economies that are still developing, the increase in the gap is also being driven by rising wage growth as these countries continue to industrialize. By 2050, the total gap is a predicted to be a staggering sum of $400 trillion – roughly five times the size of the global economy today.

by

Han Yik*

Depending on where you live, you could have a pension waiting for you – either from the government, or your job, or your personal savings.

But is it enough?

A new report from the World Economic Forum, We’ll Live to 100 – How Can We Afford It? takes a closer look at the global pension crisis. Here are five key findings.

1. We are living much longer than what pension systems were designed for

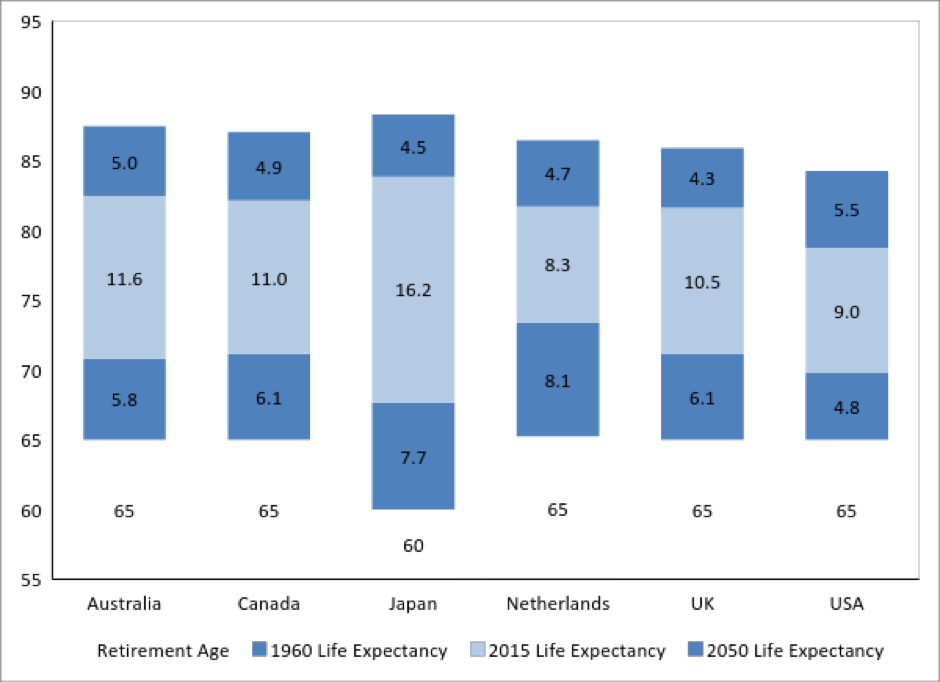

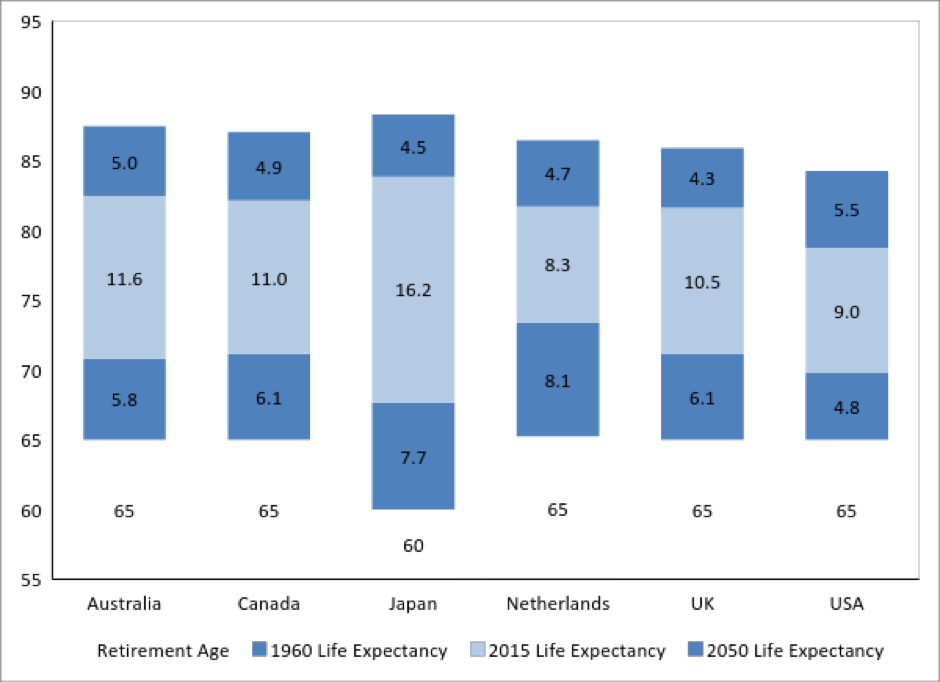

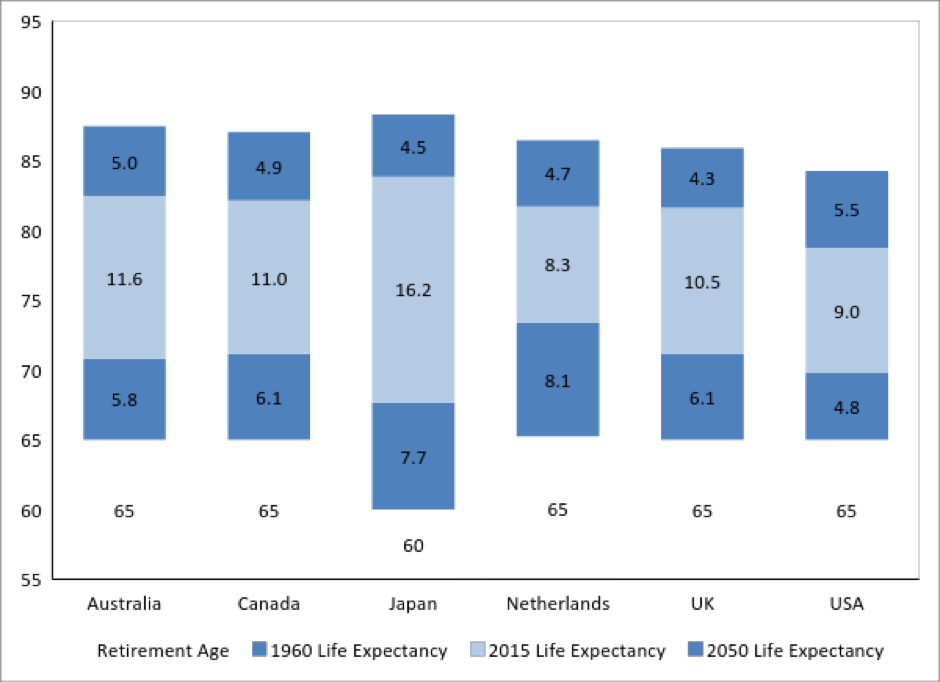

The chart below illustrates the retirement ages for the six countries with the largest pension systems.

Retirement age for most of these countries is 65 (with Japan the exception, at age 60).

The bottom bar represents the number of years of payments expected using life expectancy in 1960. This ranged from five to eight years of payments on average.

Looking at life expectancy in 2015, we can see that pensioners are now living eight to 11 years longer – and in the case of Japan, a whopping 16 years longer.

That means that pension systems are now having to pay benefits for two to three times longer than what they were designed for.

The top bar represents the expected increase in life expectancy by 2050.

2. We currently have a pension gap between what is needed for retirement and what is saved

It is difficult to define what is considered adequate income for retirement.

One common assumption is that we will need less money in retirement than we do while we are working (during wealth accumulation).

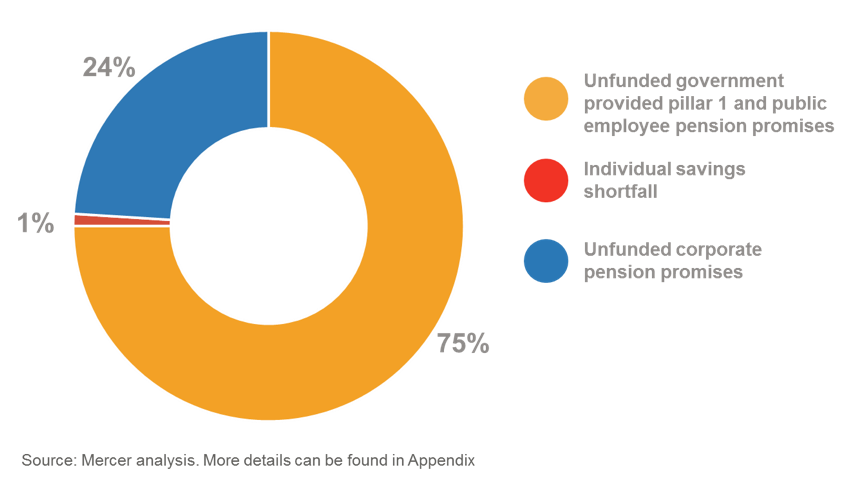

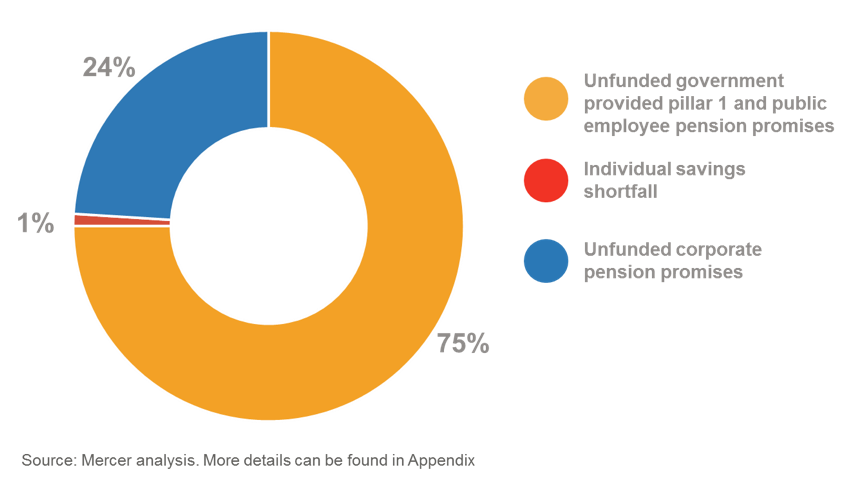

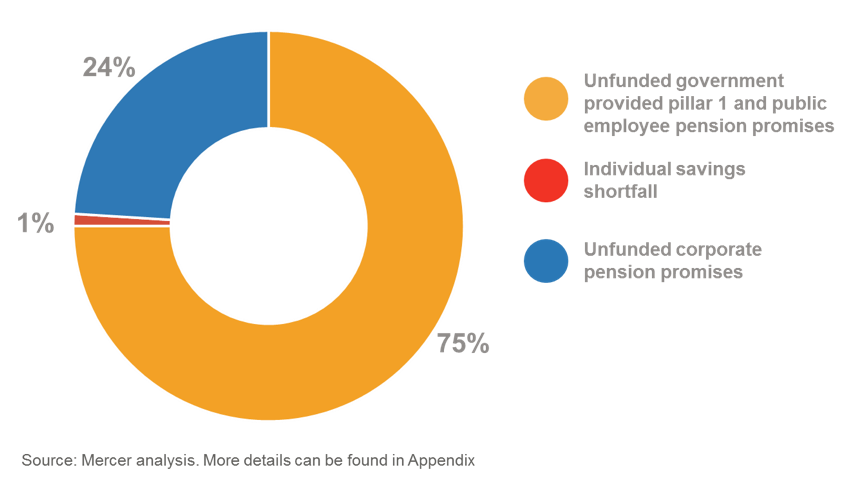

There are three main sources of income during retirement: government sponsored pensions, work or occupational pension plans, and personal savings.

Because we are living so much longer these days, there is a gap between what we need during retirement and what we have available, even among countries with developed pension systems.

Add the two most populous countries (China and India), and one can see why this is truly a global pension crisis.

3. The problem is worse for women

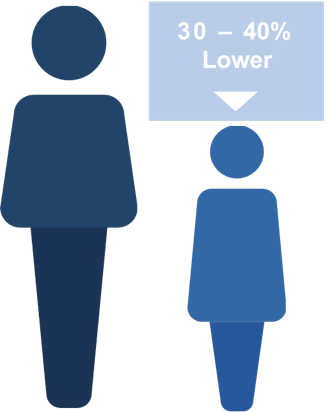

As if the wage gap wasn't enough of a problem, women have it worse with the pension gap as well.

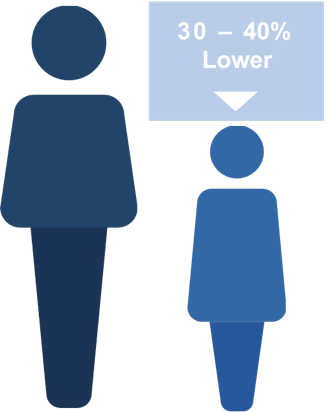

Globally, retirement balances for women are typically 30-40% lower than that of men.

Lower wages account for some of this imbalance, but coupled with longer-life expectancies for women, these smaller balances then need to be stretched over a longer period of time as well.

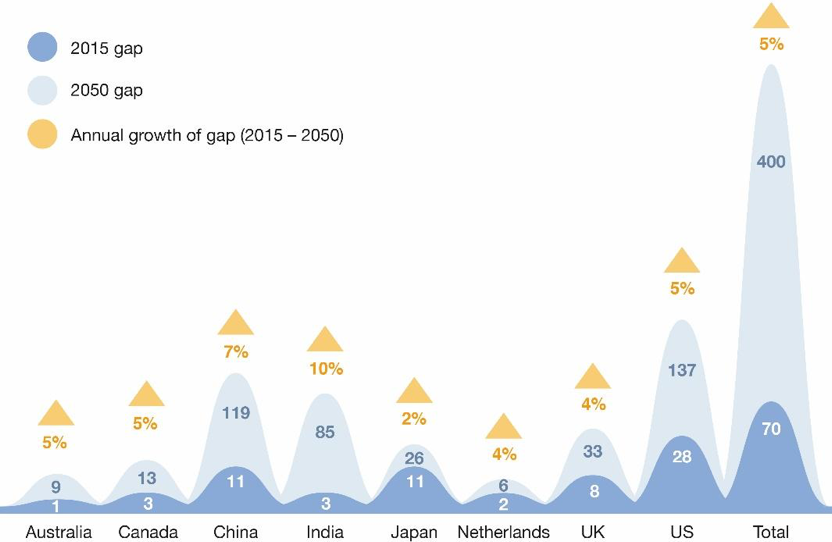

4. The gap is growing at an alarming rate

This problem is getting worse.

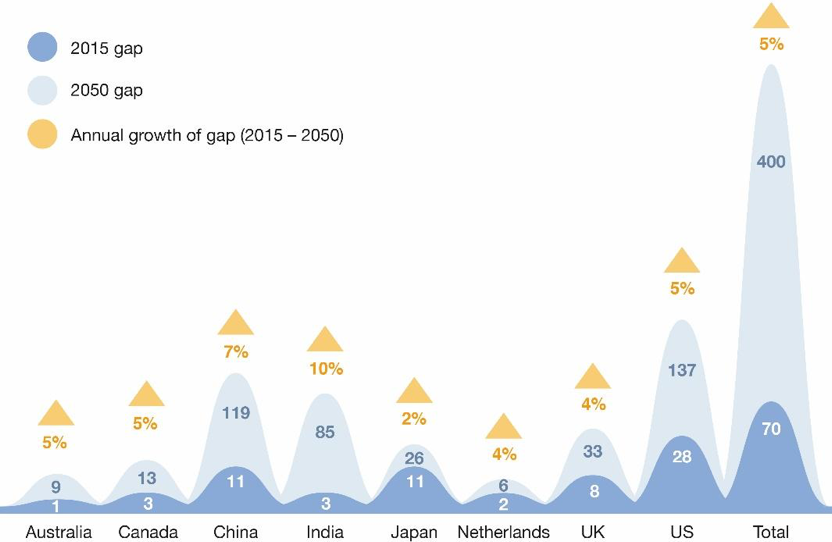

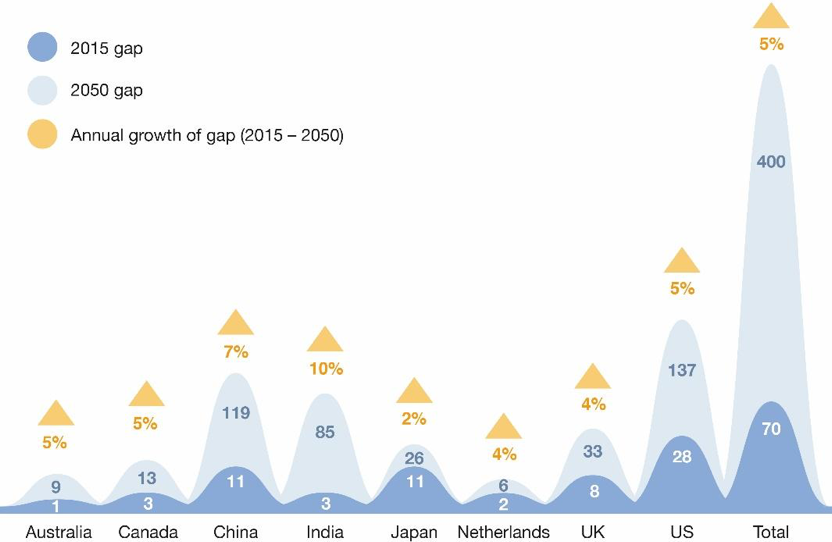

In the chart below, we have illustrated both the gap in 2015 as well as the gap by 2050.

For all countries, this is being driven by continued increases in life expectancy.

For some countries, there is also a demographic challenge of an ageing population with fewer workers to support them.

For economies that are still developing, the increase in the gap is also being driven by rising wage growth as these countries continue to industrialize. By 2050, the total gap is a predicted to be a staggering sum of $400 trillion – roughly five times the size of the global economy today.

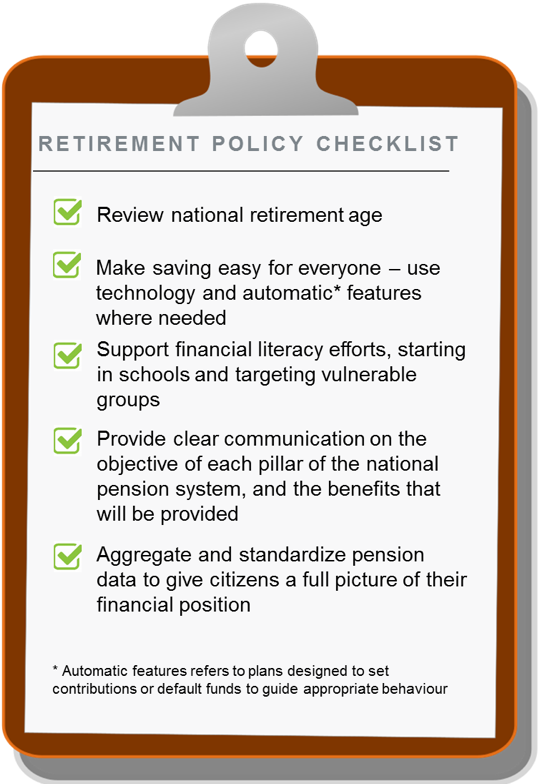

5. We need to act now

This is a difficult problem for policy-makers to address.

Politically, it is easy to ignore the future. But, as we have shown, this will lead to us paying a massive economic price.

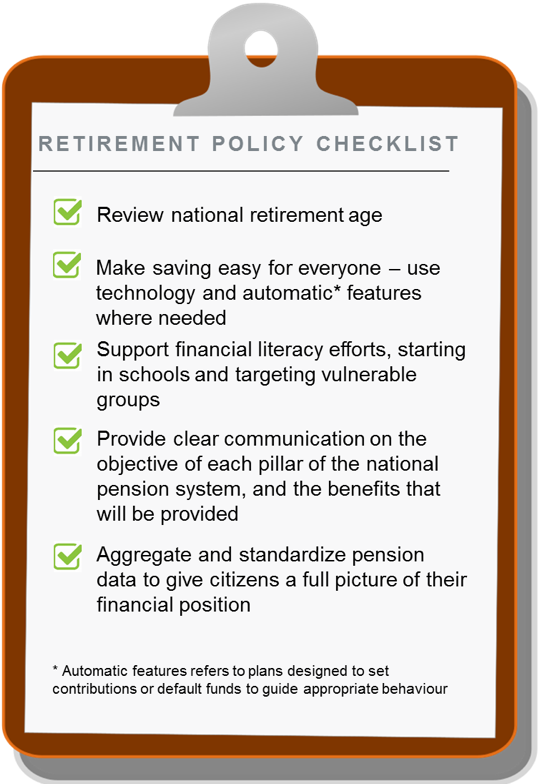

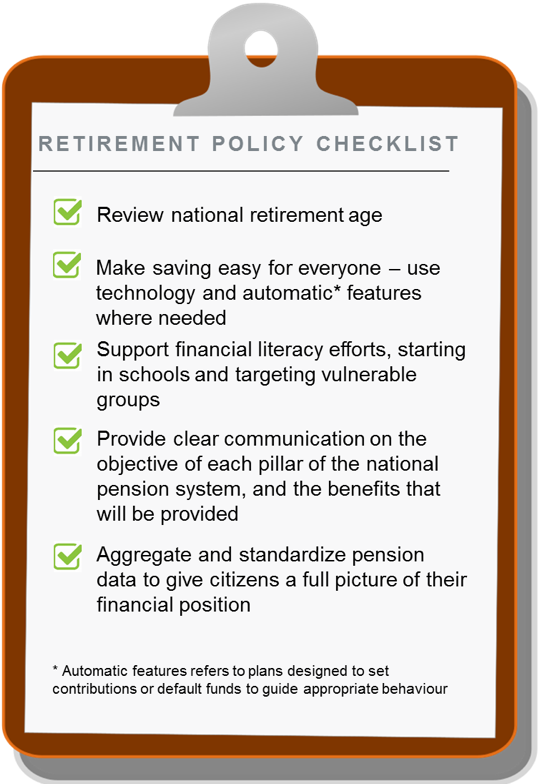

We have proposed a series of measures for policy-makers to look at today:

*Head of Institutional Investors, World Economic Forum

**First published in www.weforum.org