Getting out of a low inflation environment is proving much harder than what we thought

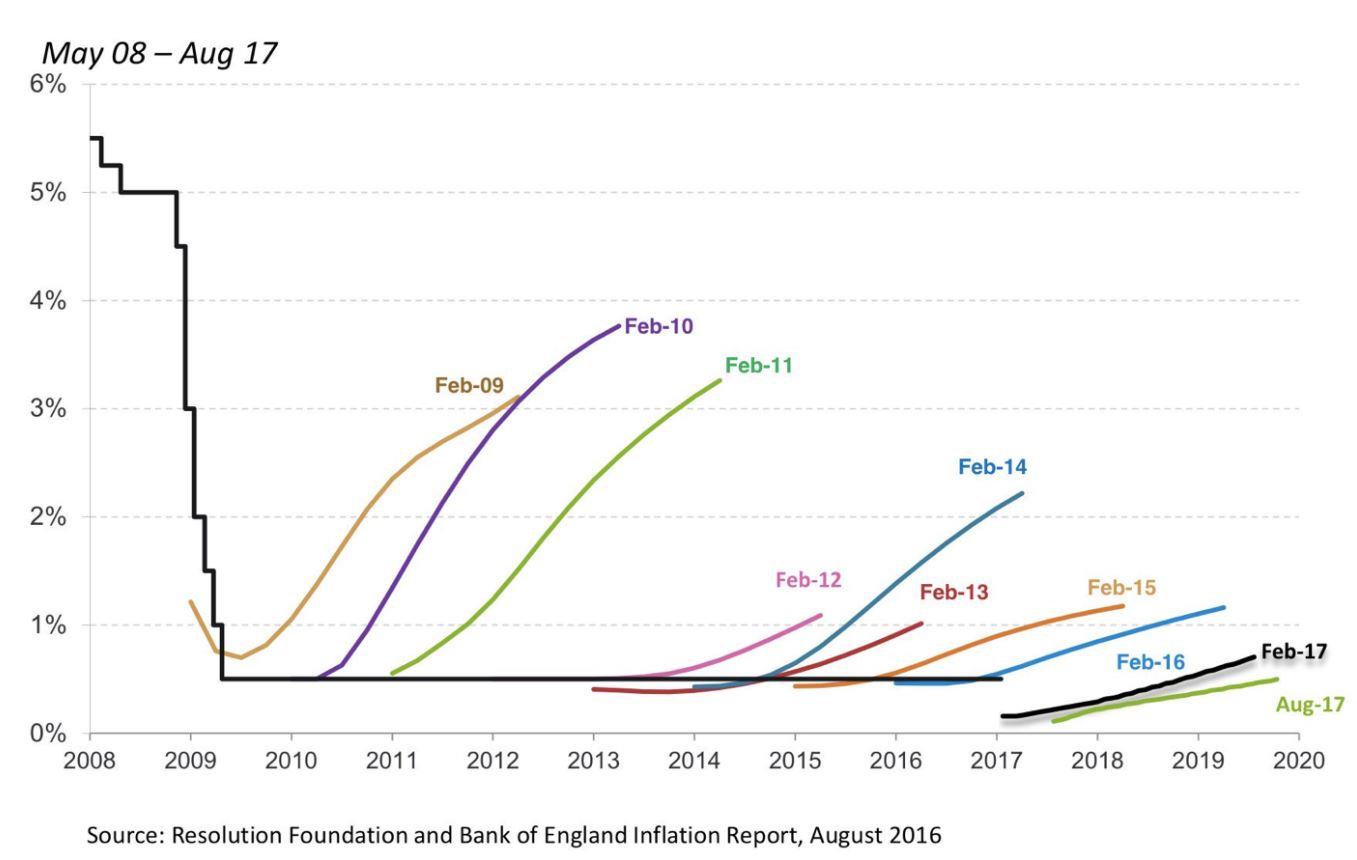

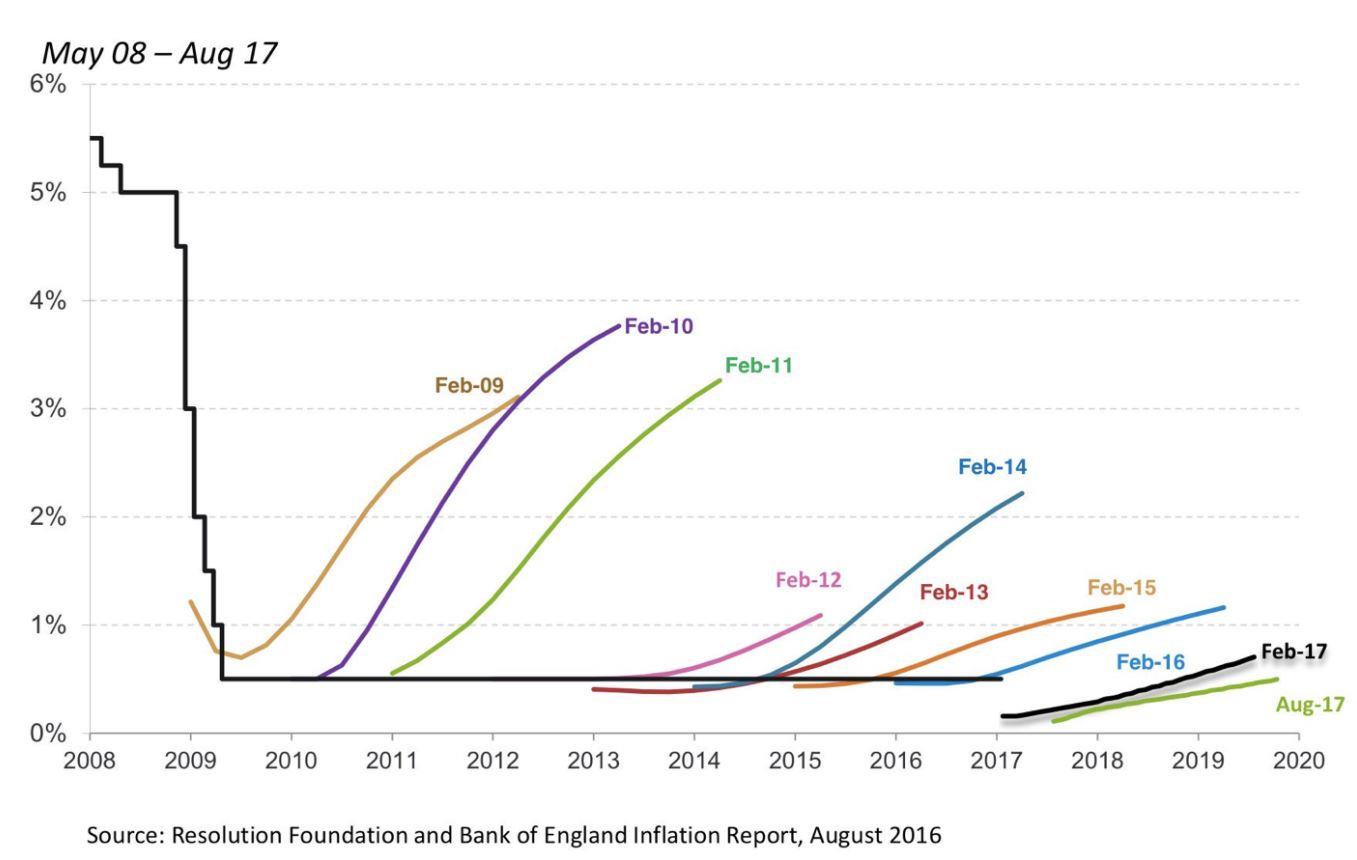

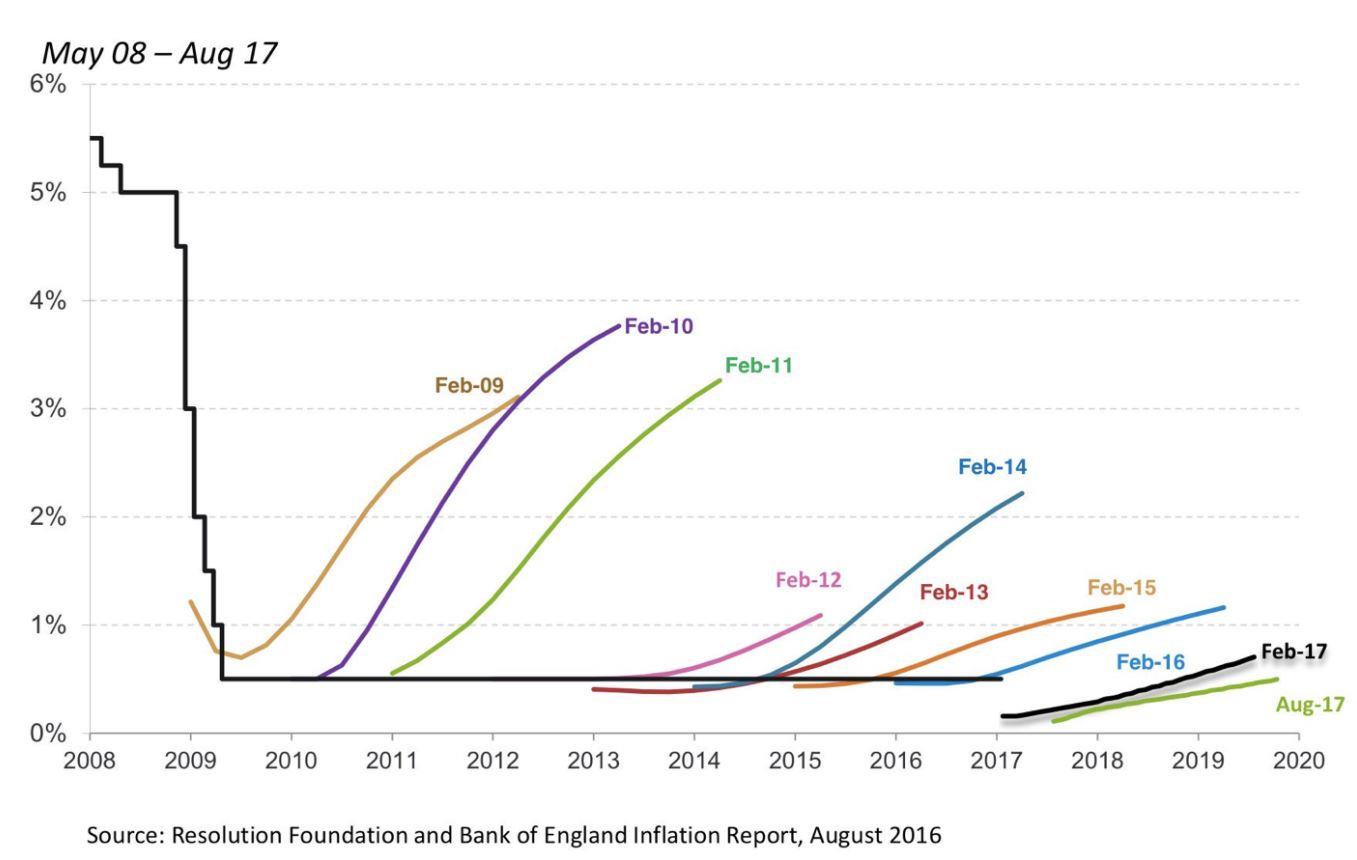

Since 5 March 2009 (more than nine years ago), when interest rates were lowered to 0.5 percent in the U.K., we have not seen much action despite all the talk and promises of higher interest rates. And inaction of interest rates has come mostly as a surprise as projections on interest rates were always much higher than what was later delivered by the central bank (see image below).

by

Antonio Fatas*

Mark Carney, the governor of the Bank of England, did his best last week to justify the decision of keeping the Bank of England’s interest rates at 0.5 percent at the same time that it was promising that the economic momentum will be regained and that interest rates will have to rise soon.

Unfortunately, this is not new. Since 5 March 2009 (more than nine years ago), when interest rates were lowered to 0.5 percent in the U.K., we have not seen much action despite all the talk and promises of higher interest rates. And inaction of interest rates has come mostly as a surprise as projections on interest rates were always much higher than what was later delivered by the central bank (see image below).

What we are seeing in the U.K. is not different from what we have seen in the United States after the Federal Reserve stopped quantitative easing and engaged in a slow path of increasing interest rates. So far there have only been surprises in one direction: The Federal Reserve ended up postponing an interest rate increase that was anticipated by the market. The ECB and the Bank of Japan are still far from getting to the point of talking about higher interest rates but when they do, they will likely face the same issues.

Either central banks are setting the wrong market expectations or they are as surprised as everyone else by the slow pace of economic growth and wage and price inflation. Regardless of the reason, this is a reminder that the last nine years have not been normal for monetary policy. We have learnt that getting out of a low inflation environment is much harder than what we thought. And if history is an indication, let's not forget that one of these days, we will have another global crisis and interest rates will have to come down (from 0.5 percent?). We will then start all over again, hoping to get out of the situation within the next ten years. Will interest rates be clearly above zero in these markets ten years from now? Chances are that they will not be.

And given all these lessons and persistence of low interest rates, you would think that we would have spent some time thinking about how to avoid falling into similar situations in the future. Unfortunately, we have not. The most obvious solution is to raise the inflation target so that we all move away from zero percent, but that is clearly not an option in any of these countries. I do not like the expression "the new normal" because it is applied too often – even when nothing has really changed – but in this case there is no doubt that ten years ago, monetary policy entered the new normal and we are not sure when we will get out of it.

*Professor of Economics and the Portuguese Council Chaired Professor of European Studies at INSEAD