Eurasia Drilling Company (EDC) is one of the largest Russian drilling companies, covering some 16% of the Russian market. Due to its size and high specialisation in drilling both onshore and offshore, it has in the past attracted the attention of several foreign investors to acquire its stakes.

Exact and reliable figures are hard to come by but the Tyumen Association of Oil and Gas Industry estimates that the share of foreign players in the national oil and gas market in Russia has grown six-fold from 2002 to 2012 and now accounts for no less than 65 per cent of the entire market. Other estimates put the share of foreign oil service enterprises on the Russian market at 49-52 per cent.

by

Martin Banks

The company is currently the target for two major suitors. The glittering price for any eventual "victor" is not difficult to understand: control of a big – and independent - player in the lucrative oil service market.

The biggest offer so far has come from Schlumberger, a US company, which for the second time is trying to strike a deal to acquire 51% of stakes in EDC. The deal will have to be validated by the Russian Federal Antimonopoly Service (FAS), which has expressed concern.

Russia's deputy Prime Minister Arkady Dvorkovich recently said that approval of any Schulumberger-backed deal would have to be delayed due to the "unpredictable situation" regarding western sanctions against Russia. The fear is that sanctions could force EDC to halt its operations soon after any deal.

The head of the Federal Antimonopoly Service in Russia is on record as describing a potential buy out by the American company as "extremely problematic." Russian Environment Minister Sergey Donskoy has offered a possible solution, in the event of a successful Schlumberger bid: transferring EDC into Russian jurisdiction.

The second offer to invest $150 million in Eurasia Drilling Company comes from a joint investment fund composed of the Russian Direct Investment Fund (RDIF), Russia-China Investment Fund (RCIF) and investors from the Middle East, among them Saudi Arabian Saudi Aramco.

But this deal has also run into trouble, partly because of the "disruption" it could potentially cause in the Russian oil service markets.

The big concern is that such a deal will change the energy landscape and significantly increase the foreign presence in Russia's domestic energy markets.

Indeed, latest data reveals the full scale to which foreign investors have now got a foothold in the highly lucrative Russian energy market.

Exact and reliable figures are hard to come by but the Tyumen Association of Oil and Gas Industry estimates that the share of foreign players in the national oil and gas market in Russia has grown six-fold from 2002 to 2012 and now accounts for no less than 65 per cent of the entire market. Other estimates put the share of foreign oil service enterprises on the Russian market at 49-52 per cent.

It isn't just Schlumberger that has tried to get an even stronger foothold on the Russian market – so too have other Western companies such as the American firm Baker Hughes, one of the world's largest oil field services companies and Halliburton, another American multinational corporation and one of the world's largest oil field service companies.

This is not the first time that Schlumberger, which already controls some 11 per cent of the Russian oil service market, has tried to seize effective control of EDC, most recently in September 2015 when it tried to gain a 47.65 per cent in the company for about $1.7billion.

This would have allowed the American outfit to raise its shares in EDC up to 100 per cent. A successful Schlumberger bid now would increase the American company's investment stake in Russia to some 29 per cent.

Schlumberger was rebuffed on the two previous occasions for much the same reason: rising fears that Russia was fast becoming a "honeypot" for overseas energy investors.

EDC, which specialises in both onshore and offshore drilling in strategic Russian fields, is currently the subject of a "tug-of-war" not least because it has proved an economic success story and whose market share in 2016 amounted to 16 per cent.

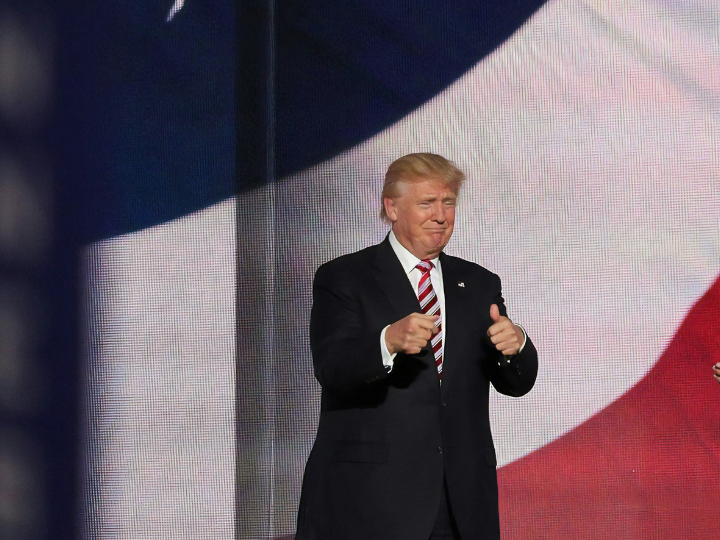

However, the spectre of yet another foreign presence on the energy scene in Russia does not sit easily with the authorities in Russia, who point to the "America-first" mantra being peddled by President Trump in the United States. Since his election, President Trump has made no secret of the fact that he will pursue a robust protectionist trade agenda.

The appointment as Secretary of State of Rex Tillerson, formerly chief executive of oil giant Exxon Mobil and with no previous political experience, also denotes renewed relevance of the energy sector in the US and has only served to add to the uncertainty about future American energy policy, not just in Russia but around the world.

Europe itself has not been immune to the prevailing protectionist trends with some European Union member states calling for the erection of tough new trade barriers in various sectors.

As one leading Brussels-based energy expert told EBR: "The feeling is that what is good for the US, that is, protecting its own markets, is good for other countries too and that includes Russia."

He added, "Such developments and especially the sudden and unexpected introduction of Saudi Arabia - a country previously absent in the Russian energy market sector - have raised real and perfectly understandable concern among the country's energy experts and authorities that the Saudi company is working alongside its American counterpart Schlumberger to secure a predominant position in the Russian oil service market".

With serious question marks against both the two current bids, the future of EDC remains unclear. But, as the Russian authorities are particularly keen to avoid yielding control of one of the country's most prized energy assets, do not be surprised if another would-be suitor emerges.

By: N. Peter Kramer

By: N. Peter Kramer