“I sincerely believe that banking establishments are more dangerous than standing armies” Thomas Jefferson 3rd president of the United States (1743-1826)

by

Dr Antonis Zairis* and

George Zairis*

A Bank is a risky business with the possibility of default. Consequently, it is not absurd to state that banking is one of the most regulated industries in the world (Chortareas, Girardone and Ventouri, 2012).

It is an undeniable fact that, with the advent of financial crisis, banking regulation and supervision play an even more important and leading role on the stability of the banking system than before. The aim of this essay is to focus on two major points:

Firstly, to analyse the impact of banking regulation and supervision on the banking system’s overall stability and secondly to try to give an answer to the following question: ‘’will a more firmly supervised and regulated system be more appropriate to secure the robustness of the global banking system?” And secondly, this essay will focus on the controversial aspect of banking regulation and supervision while in parallel we will discuss the impact of banking regulation and supervision in the Euro Area and Greece.

To begin with, it is essential to give a clear definition of what regulation and supervision mean. The term regulation refers to the setting of the particular principles that firms or banks need to obey to. These might be a set of laws, rules or legislation to be stipulated by the appropriate regulatory agency. On the other hand, supervision is a term used to allude to the general oversight of the behavior of firms and banks (Casu, Girardone and Molineux, 2007).This means that the main difference between banking regulation and supervision is that the first include the law-on-the-books while the second include the actual implementation of these laws.

Measuring banking soundness

As the main purpose of the essay is to discuss the effects of banking regulation, it is very important to have a specific measurement of the bank’s soundness and robustness. This measure is the Z-score. The basic principle of the z-score measure is “to relate a bank’s capital level to variability in its returns, so that one can know how much variability in returns can be absorbed by capital without the bank becoming insolvent.

The variability in returns is typically measured by the standard deviation of Return on Assets (ROA) as the denominator of z-score, while the numerator of the ratio is typically defined as the ratio of equity capital to assets plus ROA"(Li, Tripe, and Malone,2017). So, z-score can be calculated by the following equation:

(Average Return on assets(ROA) + equity/assets)/( standard deviation of the return of assets(ROA) )

Z-score catches the probability of default of a country’s banking system and it can be explained as the number of standard deviations below the mean by which returns would have to fall to wipe out bank equity (Demirguc-Kunt, Detragiache and Tressel, 2008).

From the measurements with z-score we can conclude that a low-risk bank or a country's low-risk banking sector will have a high value of z-score, demonstrating that an extensive number of the standard deviation of a bank's asset return need to drop to become insolvent. On the other hand, a high-risk bank or a country's high-risk banking sector will have a low value of z-score (Li, Tripe, and Malone, 2017).

When we use z-scores to measure bank soundness, we should take into consideration that this kind of measurement is an accounting-based measure. This means that we may face problems when we try to measure the soundness in low income and undeveloped countries where accounting standards have a tendency to be unavailable. Moreover, in these countries laws and regulations might not be enforced as they should.

Furthermore, z-score may fail to find an appropriate correlation due to the sample of banks which is examined. For instance, we will fail to have a clear result if in the same sample we include big institutions or investment banks with small banks.

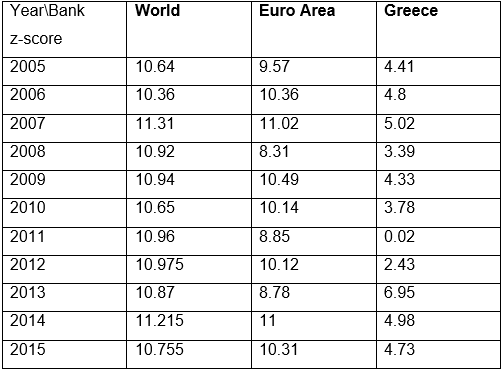

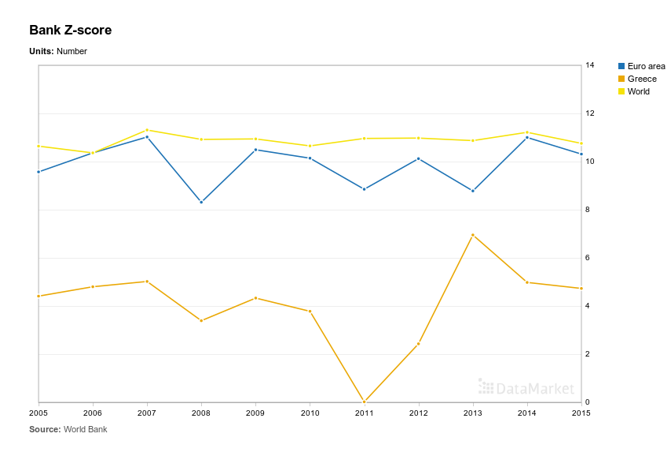

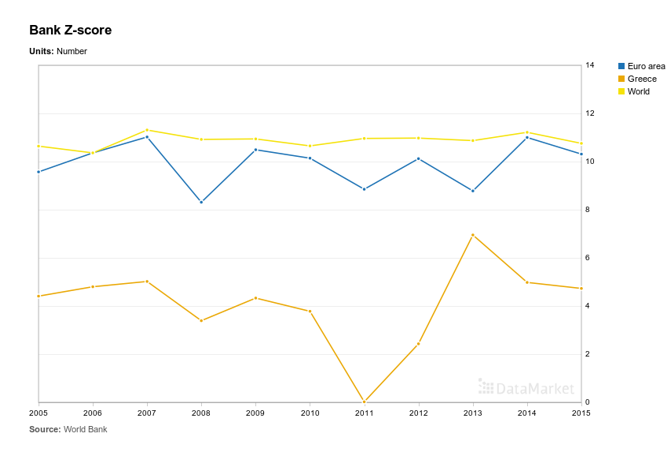

In this essay, three different z-scores will be examined and compared. The first one will be the world z-score which contains 220 countries from all over the world in the years 2005-2015, a period that includes the financial crisis in. The second one contains the countries of the euro area and the third one, the case of Greece, a country which is one of the most recent examples of strict banking regulation if the introduction of capital controls in 2015 is taken into consideration.

The table and the values used are as follows:

Source: Global Financial Development

Banking Regulation and Supervision

Regulation plays the role of the external power in the capital optimization procedure as banks set simultaneously the level of capital and a number of risky assets to hold in order to acquiesce with the minimum capital ratio.

Nevertheless, if we consider the moral hazard and asymmetries of information characterizing the banking activity, sometimes banks might have perverse motives that incite them to increase risk when called to respond to stricter capital requirements, in order to keep their desired leverage (Tandra, 2015).

As for the banking supervision, it is significant to refer to that the main point when we measure supervisory effectiveness is sanctions and on-site audits and what is the impact is on the level of bank risk in bank portfolios (Delis and Staikouras,2011).

As we desire to find the effects of banking regulation and supervision, it is very significant to refer to the regulatory and supervisory authorities which differ from country to country as every country has different institutional settings and characteristics.

On the other hand, there are some criteria that all banks should meet that are set by the Basel Committee on Banking Supervision (BCBS) and more specifically by the more recent programme “Basel III”. The Committee concludes that the greatest weaknesses of the banking sector, which mainly caused the crisis, have been the excessive leverage, inadequate capital and insufficient liquidity of many financial institutions. Therefore, the Committee proposes regulations and measures to strengthen the above systemic inadequacies.

When we examine the z-score on a global level we can observe a normality with little to no fluctuations. This is foreseeable if we take into account the large number of countries which include banks that have large differences in their risk profiles. In addition, each country in the sample can be characterized by a different banking system style and different macroeconomic factors such as economic growth, inflation, external debt, current account balance and other factors (Klomp and de Haan, 2015).

Furthermore, we should also take into consideration that the factor of corruption or inefficient enforcement of the law is also something very important in banking regulation because, in many countries, banks do not follow the rights and rules of the regulatory authorities.

Banking Regulation and Supervision in the Euro Area

The banking regulation in the Euro Area has been split into two main segments. The first one is the regulatory level of the national authorities which oversight the operation of the financial institutions such as banks in accordance with the national specificities in all countries of the Eurozone. The second one is the direction given by the European Union which is compulsory for all the members but at the same timel, those directives are modified by the countries into their own legal framework and regulation in accordance with the national characteristics and particularities.

From the speech of the chairman of the ECB’s supervisory Board at the European Banking Federation’s SSM Forum, Daniele Nouv, on the 6th of April of 2016, it can be summarized that after the low z-scores in the years 2012-2013 which were the years of turmoil in the Eurozone, the priority of the regulatory reform is to increase the resilience of the banks. In order to succeed this, the European banks should develop their capital positions, in other words, they should aim to hold more capital.

It does not seem to be a coincidence that if we observe the bank z-score graph of the euro area we can note a rise from 2013 to 2014, an expected behavior if we take into account that since 2012 the CET1 ratio, which is a capital measure that was introduced in 2014 as precautionary measure to protect the economy from financial crisis, has risen, on average, from 9% to around 13% .This increase in capital ratio is a notable achievement in terms of conforming to the new regulatory reality.

On the other hand, we should not forget that regulation and supervision do not affect low-risk banks but have a very important effect on high-risk banks. For instance, the banks in Germany, which is the most powerful member of the Eurozone, have different characteristics from the banks in Greece which appears and is believed to be one of the weakest members in the Eurozone.

Similarly, Chortareas, Girardone, and Ventouri (2010) investigate the case of the Euro Area and conclude that actions with the aim to restrict bank activities can have the reverse result in banking performance and, instead of a higher banking performance, the result will be an increase in the probability of a banking crisis. Moreover, tighter regulations on banking activities resulted in serious increases to the cost of financial intermediation.

The case of Greece

Greek banking law and supervision has been altered in order to “catch” the fast pace of the powerful members of the euro area and adjust to the rigorous EU initiatives. Although the last ten years Greek banks have not an easy mission to adapt in the global financial crisis.

We should take into consideration that they have experienced continuous challenging conditions such as the successive credit rating downgrades of the Hellenic Republic (from A in 2007 to CCC in 2015 by Fitch), the restructuring of the public debt through participation of the private sector (“PSI”) in 2009, the continuous uncertainty regarding Greece’s continued participation in the Eurozone (referendum in 2015), the tremendous rise of non-performing loans (“NPLs”) and depletion of the loan portfolio quality, the unavailability of interbanking or capital markets funding and finally the capital controls.

So, given the fact that the situation in Greece was so difficult, the Greek Government with the cooperation of the regulatory authority in Greece, the Bank of Greece (BoG), adopt the following way to recover:

1. Ask for help from the emergency liquidity assistance mechanism (“ELA”)

2. Persuade all Greek banks to increase their capital base to a conservatively (after the stress tests) estimated adequate level and thus either recapitalize or rehabilitate

3. Request guidance and assistance from the European Commission (“Commission”), the European Central Bank (“ECB”) and the International Monetary Fund (“IMF”) for the implementation of reforms in the financial sector via the “controversial” (for the Greek people) first ,second and third economic adjustment programs.

If we take into account the above facts and observe the bank z-scores on page 3, it is absolutely logical that in 2007, in which regulations were not so tight, we can observe a small decrease in z-score values due to the unprepared Greek banks dealing with the global financial crisis.

After 5 years, in 2011 the z-score value is almost zero because of the political uncertainty and the lack of regulatory authorities in Greek banks. But from 2011, leading to the relief effort of ECB with its correct regulatory and supervisory mechanism we can observe an upward trend in the values of z-score until 2013 when political uneasiness proved able to upset the environment.

Since 2014, under the SSM Framework Regulation, the ECB has direct supervisory jurisdiction in relation to the prudential and governance requirements over the four banks of Greece that are systemically important to the EU financial stability. This action has an impact the absolute transformation of the supervisory banking system in Greece since the ECB through its Supervisory Board and Governing Council is exclusively competent for the supervision of the most crucial part of the Greek banking sector.

The Bank of Greece (BoG) retained its exclusive supervisory powers only on the few remaining smaller Greek banks that include a small market share less than 10% ( Rigakou,2017). Therefore, we can conclude that the change in the supervisory authority in Greece had a positive impact on Greek banks. In 2015, Greek government reached the end of its bailout extension period without having come to an agreement for further extension with its creditors.

As a result, ECB took the decision not to increase the level of ELA for Greek banks which had as a consequence the introduction of capital controls in June 2015.In this year we can observe a downward trend in z-score values. It is a fact that very strict regulations, such as capital controls push the z-score down, do not reduce banking risk (Klomp and de Haan, 2015). But in the case of Greece, if the BoG should not enforced this strict form of regulation, Greek banks will have an even bigger liquidity problem which may cause another collapse in the banking sector.

Even if we analyse the world in general, the euro area or Greece, it is a fact that when we talk about supervision, auditing plays a very crucial role in the discipline of banks. Firstly, a direct effect of banking supervision is the creation of more exact and accurate financial reports. Secondly, they boost market discipline through public disclosure of audit findings and finally enhance supervisory discipline as the auditors' disclosures may form the basis for the application of recovering actions by supervisory authorities.

On the other hand, there is a strong correlation between powerful supervisors, which might use their power to satisfy their own incentives and corruption. This happened because supervisors - instead of having as a priority a better bank performance - focus on attract voters or donations because they have incentives to push a specific political party (Barth, Caprio Jr, and Levine, 2004).

Conclusion

Banking regulation and supervision will always be a controversial issue. This happens because the effectiveness of banking regulation and supervision depends not only on data and regressions that shows bank robustness and the correlation with the regulatory or supervisory framework but also on other factors, such as the economic cycle, country, and the type of capital considered.

As we examine in this paper, we can conclude that, in general, banking regulation and supervision has a positive effect in banking soundness while a more strictly and tightly banking system will always be a controversial issue because in some cases, like the occasion of Greece helped for the banking stability but in many other cases, a strictly and tightly banking system can may have a negative impact in the development of banks.

*Vice President Hellenic Retail Business Association

*University of Edinburgh, Banking and Risk