by Frederico Belo and Maria Ana Vitorino*

The value of a firm used to be easily calculated on a balance sheet. Assets and losses were physical entities and were tallied accordingly. But over the past 40 years, other, more intangible assets have come into play when we determine the value of a firm. Ideas, such as knowledge and brand assets, are understood to have value – but how much?

In a recent article co-authored with Vito Gala and Juliana Salomao in the Journal of Financial Economics, we break down the different assets, including intangibles, that a firm is composed of and assign them a value using a sample of firm-level annual data from 1975 to 2016. Our model explains the variation of market values over time and the variation of value across different types of firms and in different industries.

The typical response to “What is the fundamental value of a company?” is obtained through a present value approach. The equity value of a company is simply equal to the present discounted value of all the future cash flows (dividends) that the firm is expected to distribute to its shareholders in the future. In an earlier paper, Belo used a supply approach to valuation to implement this idea.

The traditional valuation approach does not explicitly account for the value of intangibles or the value of the labour force. Our more finely tuned firm valuation is performed through the lens of a model of firm behaviour. We link our estimates to a model of the firm.

How to quantify the intangible

The importance of physical capital inputs is undeniable, and we expand that framework by including other types of capital inputs. Intangible assets are brand or knowledge capital created within the firm over time. We construct accounting measures of a firm’s stock of intangibles. Also, we consider the labour force as another type of capital input.

Workers are important, of course, but the baseline neoclassical framework allows for firms to hire workers whenever it is necessary. So in a traditional scenario, the labour force doesn’t add value because the workers are paid the marginal products of labour.

Now, in a world where there is friction to hiring workers – posting a job advert, searching for workers, taking time to interview – it’s no longer very easy to find a good match for a position. With this in mind, the workforce currently in the firm has a certain value because the firm has already found these workers. Through their talent and contributions, workers add to the firm value. We quantify this amount to be quite sizable; between 14 and 21 percent of a firm’s value can be attributed to the value of the labour force.

When gauging the value of the brand intangible asset, we assume that the firm creates a presence through advertising. As firms advertise, they generate and increase brand awareness. Brand capital accounts for 6 to 25 percent of a firm’s value, depending largely on whether the firm is in a high-skill or low-skill industry.

Knowledge capital is measured through research and development expenditures. As with brand capital assets, the impact of this intangible depends greatly on the type of industry a firm is in. We found that knowledge capital is between 20 and 43 percent of a firm’s value. Physical capital, traditional assets, represent between 30 and 40 percent.

An intangible split

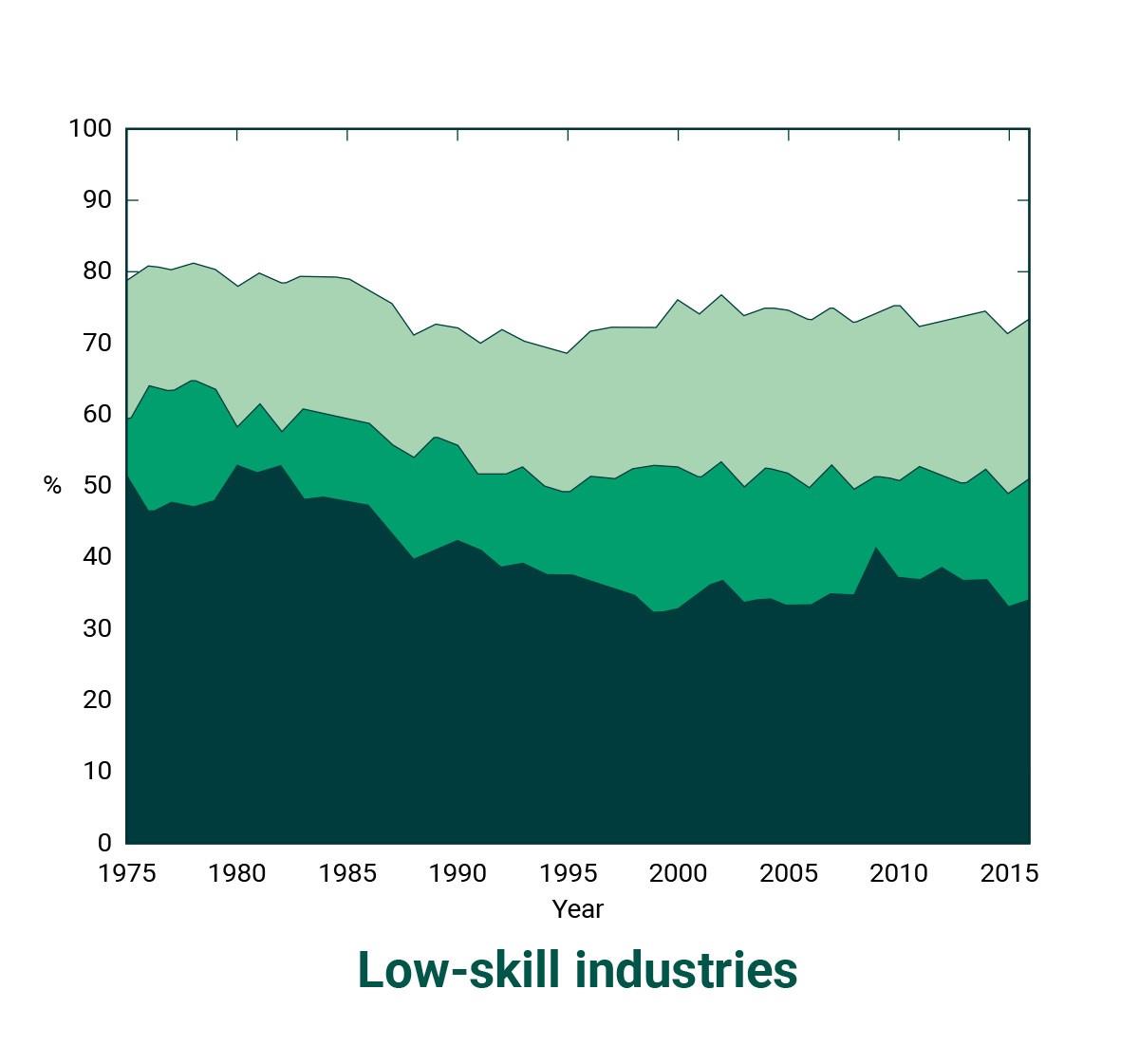

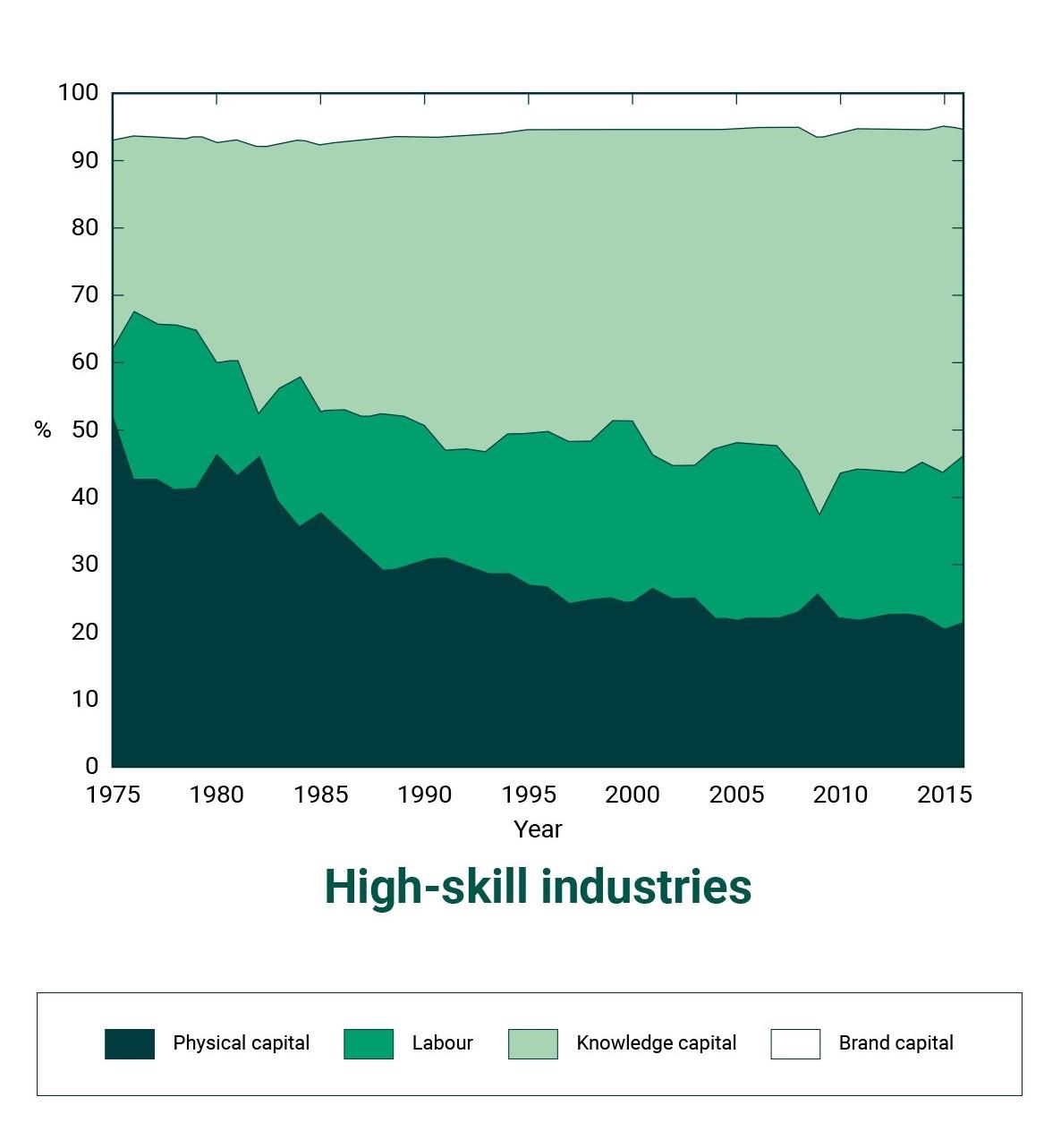

There is a noticeable difference between high-skill industries and low-skill industries in our results. High-skill industries are those with highly skilled workers, such as software firms and other new-economy firms. Low-skill industries are those with low-skilled workers, such as restaurant chains or big box stores. We found a major difference in the value of intangible assets based on a split between high- and low-skilled industries, as seen in the figures below.

In the top figure, firms in the low-skill industries have relied heavily on physical capital assets. Labour is a smaller portion of the firm value than in high-skill industries. The intangible assets of knowledge and brand are relatively consistent, with brand accounting for more value than in high-skill industries.

In the bottom figure, physical assets are of remarkably less value over time in firms in high-skill industries. Knowledge capital is noticeably the largest chunk of value for these firms and brand assets are minimal.

For example, Burger King, a firm in a low-skill industry, relies heavily on marketing to bolster its brand. Without brand recognition, the firm would lose out against other burger restaurants. Its brand is clearly part of its value.

On the other hand, Google, a firm in a high-skill industry, doesn’t need to do as much advertising. Knowledge capital is far more important and valuable – its search engines and Google suite collect data about users. The valuation of an outlier like Google is off the charts and cannot be viewed solely on its physical assets.

Over time, intangible capital has gained importance. It has become even more important than tangible capital in high-skill industries. If it continues at the current pace, physical capital will become a marginal input in industries like software, where offices are no longer necessary.

Labour across the board

Returning to our figures, the value of labour has been relatively stable. The two clear trends are the fall in the value of physical capital, as the old-economy components decline over time, and the increase in knowledge capital. Brand capital is far more stable than knowledge capital. Knowledge capital and labour are the costliest inputs in response to changing economic conditions, especially in high-skill industries.

Making changes to the stocks of capital has an adjustment cost. As we’ve already explained, labour has a value. It’s costly to fire or hire workers. This translates to the other inputs as well. It’s also expensive and time-consuming to change a brand name. To cultivate a brand name, a firm needs to generate creative ideas, develop a good marketing campaign, find the right advertising agency, all of which takes time and resources. To hire and train programmers so they are creative enough to expand the value of a firm takes time.

As the tech sector continues to thrive, despite the global pandemic, the valuation of intangibles has become relatively more important.

A useful approach to valuation

Valuation is important to executives, practitioners and investors. Implementing a valuation that accounts for intangibles gives the intrinsic value of a firm. Our model contains a formula with an estimation of the parameters, and then maps accounting variables into market values. In some cases, we can determine if the firm is currently overpriced or underpriced.

In the midst of debate amongst labour economics, including the macroeconomics literature where prominent economists think that labour is easy to adjust, some believe the adjustment costs are large and others believe it is not consequential. We provide the quantitative analysis of labour value, indicating that workers’ value to a firm is substantial and, in high-skill industries, looks to continue to grow.

*Associate Professor of Finance at INSEAD and Associate Professor of Marketing at INSEAD

**first published in: knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer