by Dorothee Herr*

“Innovative finance” is the newest buzzword used to find ways to channel money – especially private money – to nature-based solutions. But bringing nature and private investors together in a sustainable and lasting way is easier said than done.

I love nature and, especially, I love the ocean. For about 12 years now, I have worked as a conservationist trying to find pragmatic solutions for how to conserve, protect, restore and ensure sustainable use of natural resources and their ecosystems. More recently, I started to learn about private financing, now a very “hot topic” in the conservation world. The main message I have gleaned is: there is not enough public and philanthropic money available to fund nature conservation, and even if those amounts are drastically increased (which they should be) over the next few years, we still need private money to close that “funding gap”.

Then, engaging more within the finance world, I learned: There is enough private money that could potentially go to conservation, but not enough projects that can absorb private capital and are at a scale that makes sense from a private investors’ point of view.

For many projects involving the active conservation and/or restoration of ecosystems, it becomes very challenging to provide a well-developed business plan, with a clear return on investment. Especially in the coastal and marine space, we see very promising deals, yet they primarily include technologies (e.g. around by-catch reduction) or plastic-related activities. All are urgently needed, yet don’t solve the problem of how we will get private money to pay for active, direct nature conservation and restoration. Because where is the financial return in that?

Private actors engaging in nature conservation isn’t new at all. For corporate social responsibility (CSR) reasons, big and small companies have long supported conservation projects. The interest from private-capital investors is certainly also there. The emergence of a flurry of new impact investments funds is proof of that on one hand, and the engagement of multilateral development banks in nature-based solutions on the other hand. But they want, compared to pure CSR, a return on investment. And this is where it becomes tricky.

Some might argue: Do we actually need private capital to pay for the conservation, protection and/or restoration of nature? I would argue: given the above-mentioned “funding gap”, yes we do. But this is not to say that we only need private money. Some projects can simply not be paid for by return-on-investment private capital. Also, the engagement with private finance needs to happen around sound environmental and social safeguards (ESS). Especially now that it has become clearer what so-called nature-based solutions are and are not.

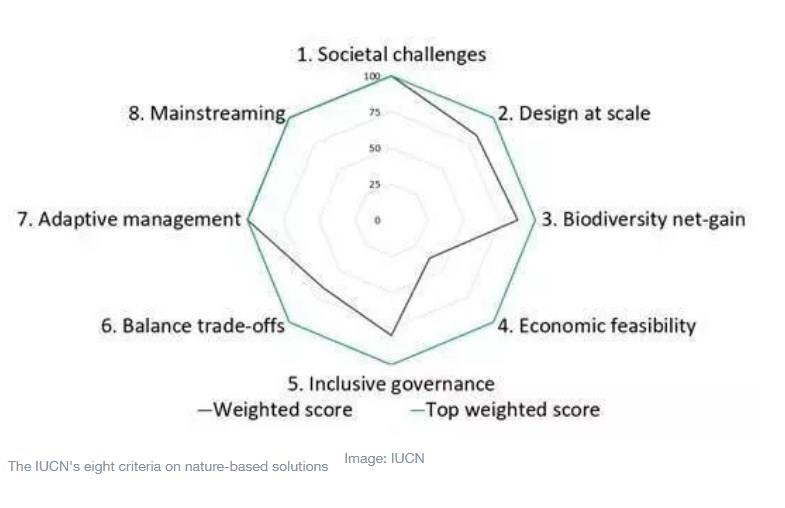

Nature-based solutions are put forward as nature’s contribution to meet societal challenges, including climate-change mitigation and adaptation, as well as food security. The UN, big corporates, small NGOs, countries all around the globe, and also the private finance sector, embrace such solutions and want to invest in them. But what has to always be avoided at all costs is greenwashing, especially if private money is involved. Yes, private money needs to come into play, but it should go without saying that only projects with active conservation, protection and/or restoration of ecosystems ought to claim, “We are investing in nature-based solutions.” The goal is to have projects conforming to the eight criteria of the IUCN Global Standard on NbS.

Which brings us back to the lack of a clear project pipeline. As part of my work at IUCN, we have been trying to identify and support investable projects in the coastal and marine space, with clear nature-based solutions. Most are linked to the well-established revenue-generating activities around sustainable natural resources management (fisheries and aquaculture), carbon trading and tourism. We received many outstanding conservation project applications, yet without a clear (or only very early stage) business plan nor the right partnerships to engage with private capital. We have also received fascinating applications from start-ups, proposing new technologies and requesting help with how to include nature-based solutions into their business concept as a whole, and finance structure in particular.

Both established projects and startups merit support “to get further off the ground”, in terms of technical assistance as well as seed/grant funding. But neither is the silver bullet in terms of getting finance to conservation at scale.

Investment projects with nature-based solutions need innovative and creative project developers and entrepreneurs; risk-taking investors, NGOs that apply high ESS, and constructive government authorities. And ideally, back-up from government entities, in a blended finance format, to support such projects through dedicated technical assistance as well as seed funding.

This journey is not a quick one, especially if it is to be one with long-lasting impacts. Bringing a diverse set of stakeholders and interests together isn’t done overnight. It’s about constant learning, adjusting of expectations, and finding compromises without losing environmental, social and ethical standards.

Luckily, there are a lot of willing actors – from all bases – out there. The signs are extremely positive: from new (ocean) investment funds to established fund managers adding nature-based solutions prominently to their new business endeavours as well as “mainstreaming” through their more traditional investment portfolios.

And the final point: Engaging with private finance is not to let governments, or CSR- and philanthropic-driven funding, off the hook. Especially this year we have seen the need to invest in nature, from all angles, to support a healthy environment for all. We heard a lot about “build back better” – some argue “build forward better” is a more suitable slogan – we cannot allow ourselves to go back to normal and only make it a bit better. We need to have much more visionary, forward-looking thinking that includes nature at its core, from policy-making all the way to private investment. And let’s lead with continued support for those visionaries, in all the shapes and forms in which they might arise.

*Manager, Oceans and Climate Change, GMPP, International Union for Conservation of Nature

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer