by Giles Merritt*

This summer the European Union will be swimming, if not drowning, in an alphabet soup of fraught global negotiations. Whether or not it emerges triumphant, these issues answer the familiar question of “what’s the EU for?”

The letters in the soup include AI, WTO, MNCs, and FANGs. It’s a menu that spans international tax arrangements, world trade rows, the regulation of data flows, digital protection rules and a new approach to the tax avoidance methods of the world’s largest and richest companies.

All are areas where Brussels plays to its strengths. Disagreements between member states often leave the EU a helpless bystander on the international stage, but on key economic questions it is a major player and generally on the side of the angels.

Topping this summer’s menu of thorny international negotiations is tax reform

Left to their own devices – as the UK is discovering to its cost – individual European countries have little to say in the ordering of rules that govern the global economy, and that’s even truer of new rules for the digital age. The EU, on the other hand, wields real clout and expertise in areas where technological and legal know-how are ace cards.

Topping this summer’s menu of thorny international negotiations is tax reform – never easy and in the aftermath of the pandemic more toxic than ever for cash-strapped governments. Finance ministers of the G7 countries meet in London later this week, ahead of the mid-month G7 summit in Cornwall, to discuss how to tighten up on corporate tax dodging.

They’ll be targeting the major multinationals that are reckoned to avoid up to a quarter of a trillion dollars in taxes every year. This astounding worldwide shortfall of $250 billion in governments’ receipts stems from such devices as shifting declared profits to tax havens and playing off host countries against each other. Prime targets are the so-called ‘FANGs’ – Facebook, Apple, Netflix and Google – but they are only the tip of the iceberg.

It’s far from easy to pin tax avoiding companies down because US, EU and other negotiators remain deeply divided over where and how wealthy multinational companies should declare their true profits. The G7 meeting will therefore be no more than a curtain-raiser for what promises to be a three-ring political circus when 139 countries meet later this year under the aegis of the OECD to thrash out the details of a worldwide clampdown on companies’ dodgy tax deals.

The Covid pandemic and the European Commission’s controversial handling of the vaccines roll-out may have dulled the EU’s international reputation. But behind the scenes, the Eurocrats and members of the EP have been preparing workmanlike contributions to the global debate on how to reset economic growth and streamline trade.

The possibility of a common EU-US front on WTO reform is kindling optimism and even great expectations

Kick-starting international business is a priority. The severe disruptions of shipping and supply chains by coronavirus lockdowns are immediate problems, but so too are the longer-term effects of the Geneva-based World Trade Organization’s paralysed dispute settlement mechanism. Unless trade rows can be fixed swiftly and fairly, the risk of a return to 1930s-style protectionism grows.

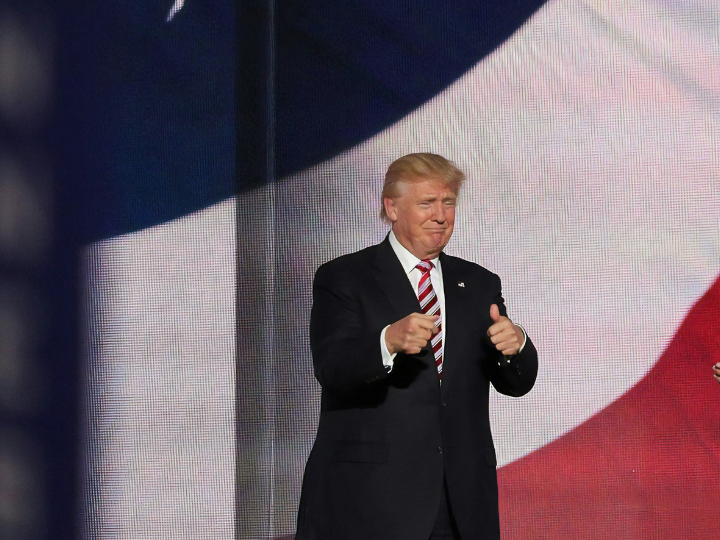

Unsurprisingly, Donald Trump is the villain of the piece. When US president, he blocked all new appointments to the WTO’s appellate body so that it no longer functions. But the malaise runs deeper. Although Trump’s gripe was that WTO rules allow China’s state-owned enterprises to enjoy unfair subsidies, the greater problem is transatlantic protectionism.

The EU recently unveiled a new trade strategy that offers Washington an olive branch by recognising that the US has “valid concerns” over WTO rules. Brussels has suggested ways to revise some definitions of what constitutes fair and unfair trade practices, and to accelerate its ponderous disputes procedures.

For once, the Covid crisis can be said to have a positive side. The WTO’s 12th summit convening its 164 member governments was to have been held last June, and with Donald Trump still in the White House there was little hope of a successful outcome. Rescheduled for November this year, the possibility of a common EU-US front on WTO reform is kindling optimism and even great expectations.

In the second part of this discussion of the EU’s role in settling a range of international regulatory issues, Giles Merritt will look at Artificial Intelligence (AI) and future rules governing digital information. It will appear on June 15.

*Founder, Friends of Europe

**first published in: www.friendsofeurope.org

By: N. Peter Kramer

By: N. Peter Kramer