by Mike Parr and Simon Minett*

What is the real cost of green hydrogen? Is there a reliable and straightforward way to obtain this cost? What information is needed? Is it valid to compare green hydrogen prices with grey or blue hydrogen prices? Mike Parr and Simon Minett attempt to answer these questions.

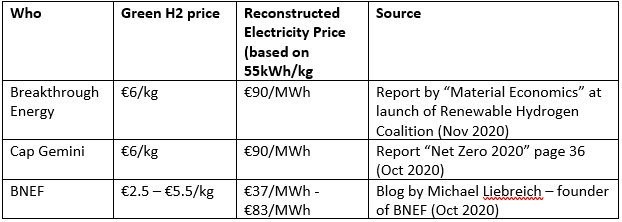

Green hydrogen is much in the news. In October Cap Gemini published a report called “Net Zero 2020”. Page 36 had a section on green hydrogen with the declaration “At around €6 per kg, green hydrogen is not competitive today with fossil energies (parity at €1/kg equivalent to €25/MWh)”.

Last week another hydrogen organisation announced itself “the Renewable Hydrogen Coalition” accompanied by (yet another) report on green hydrogen which contained (yet another) price estimate for green hydrogen – €6/kg.

Absent from the above is any explanation as to how these price were derived, a common feature of reports and blogs on the subject.

The EU and green hydrogen

Given recent European Commission publications (e.g. Hydrogen Strategy) and declarations by various EU Member States such as Germany, green hydrogen now has a prominence which contrasts with its position at the start of the year.

However, the starting point for green hydrogen policy development in the EU and Member States has to be a good understanding of how current green hydrogen prices are formed, where they currently stand and their likely future trajectory. What follows provides a true and clear view of green hydrogen price formation with current and future price developments.

Green hydrogen price formation

Green hydrogen is produced by electrolysers that use renewable electricity and water to produce hydrogen and oxygen. There are two main cost elements, capital costs (capex) for the electrolyser installation and operation (and maintenance) costs (opex).

By far the largest operational cost (circa 95%) is the cost of electricity. Electrolyser manufacturers estimate the capex/opex split at roughly 20/80 (at a utilisation rate of 40% of full load over a year). This means that 80% of costs are attributable to opex and thus electricity and 20% to capex.

The other important metric for determining green hydrogen price formation is the amount of electricity needed to convert water into hydrogen. The most commonly used figure is between 55kWh and 60kWh of electricity per kg of hydrogen production. The industry expects this to fall to around 50kWh by 2025/2030 due to technology improvements.

Public presentations by companies such as Hydrogenics and conversations with other electrolyser manufacturers confirm that the assumptions and approaches in the two preceding paragraphs are realistic and valid.

Green hydrogen production using industrial electricity prices

The table shows green hydrogen price estimates by three different organisations. Using information about green hydrogen price formation, it is possible to re-construct the electricity price on which the green hydrogen price was based. The numbers obtained suggest that industrial electricity prices (see Eurostat) were used as a basis for the green hydrogen price.

Green, grey and blue hydrogen: comparing apples and zebras

Grey and blue hydrogen are produced using natural gas which attracts almost zero taxes and levies.

By contrast green hydrogen prices have taxes and levies imposed on the feedstock (electricity) which is double/quadruple the original price of the feedstock (renewable electricity). It is neither rational nor sensible to make such a comparison between a heavily taxed product (green hydrogen) and a zero taxed product (grey or blue hydrogen).

Nevertheless, almost all commentators on the subject think that this is a valid comparison

Green hydrogen: real-world pricing

Iberdrola recently announced a project (to be completed during 2021) to build 100MW of PV and couple this to 20MW of electrolysers to produce green hydrogen that would be piped to be used at an industrial plant producing fertiliser. The cost of producing electricity from PV in Spain (or Portugal) is well understood. Conservatively, the cost is around €25/MWh. Recent projects in Portugal have been priced in the range €12 to €20/MWh.

Using the green hydrogen price formation metrics outlined previously and €25/MWh as the electricity price gives a green hydrogen price of €1.65/kg. This price is based on the assumption that the PV farm is directly coupled to the electrolysers. The approach of direct coupling between a renewable power station and electrolyser facility is becoming common.

Misleading statements

Cap Gemini’s statement “green hydrogen is not competitive today with fossil energies (parity at €1/kg equivalent to €25/MWh)” is thus both untrue and true. Given Spanish (and Portuguese) electricity prices from PV, green hydrogen produced using this electricity is cost competitive now with both blue and grey hydrogen.

However, if the electricity system is and industrial electricity prices are used then green hydrogen is hammered by taxes and levies.

Given the above, the prices for green hydrogen proposed by Cap Gemini, BNEF, the Renewable Hydrogen Coalition/Breakthrough Energy and others and the price comparisons they make are highly misleading.

Final comments

The “problem” with green hydrogen is not price parity with grey (or blue hydrogen), this parity already exists. The problem is taxes and levies on the electricity used by electrolyser installations that are not directly coupled to renewable power stations.

Rather than feeding subsidies to green hydrogen developments to compensate for high electricity prices (compared to the cost of renewable generation), EU institutions and Member States should focus on rapid electricity market reform such that electrolysers can be sited on electricity networks and only pay for real generation costs plus network charges relating to use of the network between the electrolyser installation and the local renewable power station.

If this reform takes place, the EU electrolyser industry will do the rest.

*director of PWR, a UK-based company providing market research& technical support in the field of renewables& energy efficiency and founder of Challoch-Energy, a consulting firm

**first published in: www.euractiv.com

By: N. Peter Kramer

By: N. Peter Kramer