by Agnese Ruggiero*

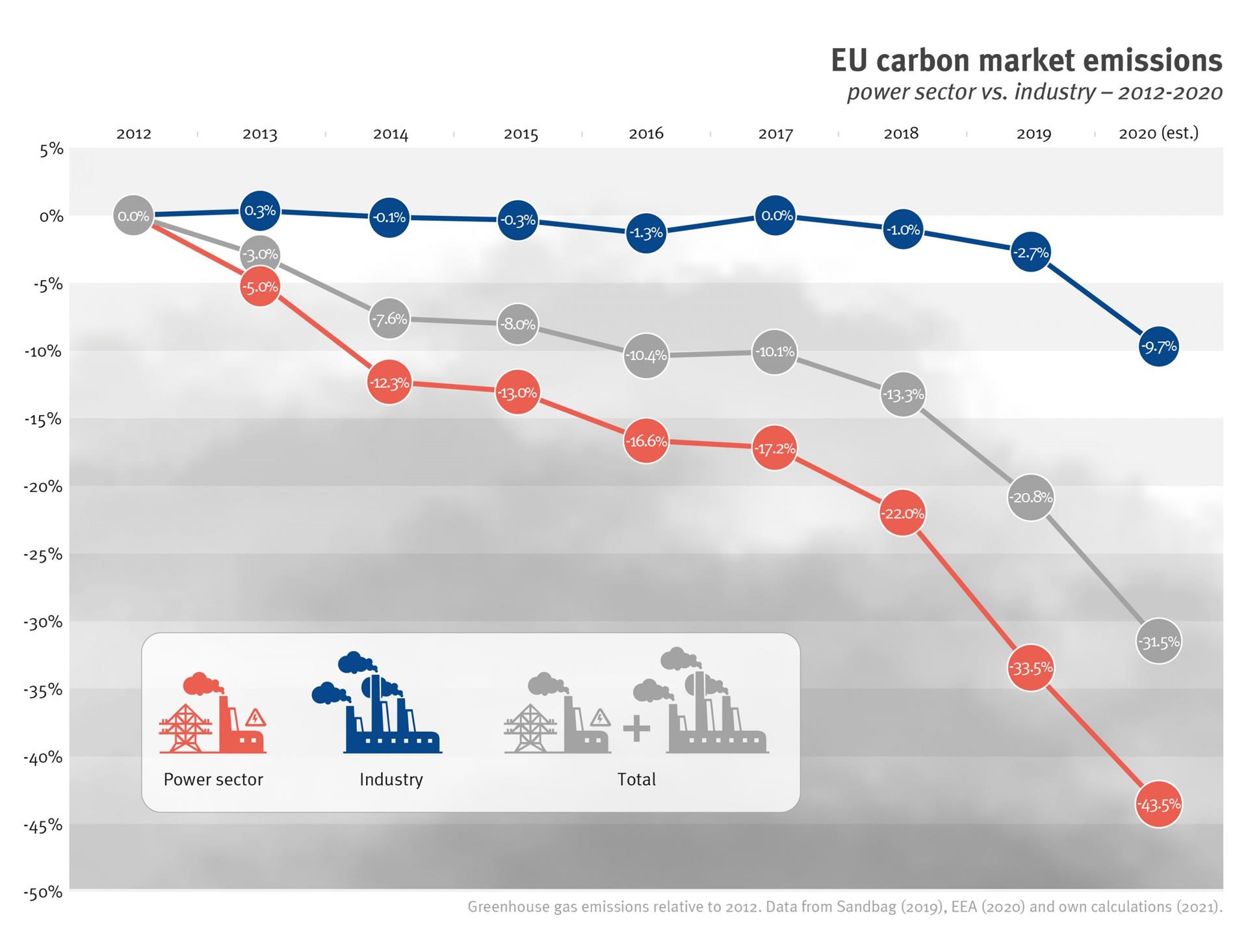

The latest EU carbon market emissions data released by European Commission on April 1 was not a joke. It shows the impact of the COVID pandemic and a total year-on-year emission reduction estimated at 13% for all installations and airlines covered by the EU carbon market.

However, data breakdown by Sandbag shows that pollution from industrial sectors, such as cement, chemicals, and steel fell by only around 7%, and this mostly due to the reduced output caused by the COVID pandemic. The power sector registered a drop of 15.6% while emissions from aviation plummeted by 63.8% (due to the grounding of flights and are expected to bounce back once travelling resumes).

In practice, this means that not only are industrial emission reductions lagging behind compared to the power sector, the pollution is also likely to rebound in the next few years.

This trend is not new. Unlike in the power sector, carbon pollution from heavy industry has hardly decreased since 2012. Without additional policies and measures, it is also not expected to go down until 2030. At the current pace, resource and energy-intensive industries are not expected to reach climate neutrality before 2060.

If Europe wants to honour its commitment to the Paris Agreement, it needs to get industry on a much faster decarbonisation path. Reforming the EU Emissions Trading System (EU ETS) is step number one.

To do its fair share of global climate action, the EU needs to cut emissions by at least 65% by 2030, and be climate-neutral by 2040. The upcoming revision of the carbon market rules is a crucial opportunity to strengthen the law and ensure that the industrial sectors covered by it reduce their emissions in line with these goals. The investments required have to be considered against the tremendous costs of inaction.

There are four key changes that would render the EU carbon market stronger and more effective, as outlined below and in our latest briefing.

1. Cut pollution faster

The scheme must speed up emission reductions to get to zero by 2040. This requires an increase in the pace at which emissions decline each year and a one-off reduction of the overall cap on carbon emissions.

The overall EU ETS cap has been significantly higher than the emissions of installations covered by it since 2009. This difference is expected to continue and to grow as a consequence of the COVID-19 pandemic and the closure of coal power plants. The surplus already increased in 2020 because of the drop in production. If the cap is not aligned with the actual overall emissions, a too-large surplus of allowances could depress the carbon price signal again in the future and undermine the system’s impact.

In policy terms, 450 million allowances should be taken off the market in 2023 as a one-off reduction of the cap, combined with the adoption of a steeper linear reduction factor of 3.1%. A later implementation of these improvements will require a greater effort in a shorter amount of time.

2. Avoid another price crash

The “Market Stability Reserve” (MSR) controls the number of allowances in circulation on the ETS market with the aim to maintain a robust price signal. While it has proven effective in recent years, the mechanism was designed to only handle oversupply accumulated in the past. It is not fit to deal with current or future surplus (linked to e.g. the COVID-19, economic downturn, planned coal plant closures…).

This tool will therefore need to be strengthened in the context of the carbon market revision. The intake rate should be increased, rather than lowered, to 36% from 2024 onwards.

3 & 4. Make polluters pay and invest revenues in future-proof solutions

So far, the EU ETS has failed to implement one of the core principles of environmental lawmaking enshrined in the EU Treaty – “that the polluter should pay”. Despite auctioning being the default rule, more than 95% of industrial emissions, and about half of emissions from aviation, are currently covered by free emission allowances.

Polluting for free in times of a climate crisis is unacceptable. Moreover, the European Court of Auditors recently found that free allocation of allowances to industry and aviation could slow decarbonisation, and needs better targeting. The upcoming review should, at last, enforce the auctioning of all emission allowances.

This is directly related to the fact that reaching climate neutrality by 2040 will require more funding for climate action, including for industrial innovation. Revenues generated from the government auctions of emission allowances contribute substantially to EU countries’ budgets. Since 2012 they have exceeded €57 billion.

However, contrary to what many governments claim, this money is not all spent on climate action. The absence of a firm rule on the use of revenues has led to a decrease in climate-related spending in almost all EU member states in the last few years.

The European Commission should propose earmarking 100% of revenues for climate action, to be invested in renewable and energy-efficient technologies, clean industrial innovation, just transition, and international climate finance.

A new hope

The current emission trends portray a dire picture. Climate neutrality by 2040 will not be achieved if energy-intensive industries do not clean up their act.

For that to happen, the EU emissions trading scheme must provide a robust carbon price signal, thereby creating an incentive for emission reduction. At the same time, it can provide some of the urgently needed resources to be invested in innovation and cleaner production models.

The revision of the law may well be the last chance to make it fit for purpose. EU policymakers must use this opportunity wisely and make the carbon market an instrument that drives the zero-carbon industrial transformation well before 2050. If the EU is to achieve its new climate goals, the time to act is now.

*first published in: www.euractiv.com

By: N. Peter Kramer

By: N. Peter Kramer