by Katharina Buchholz*

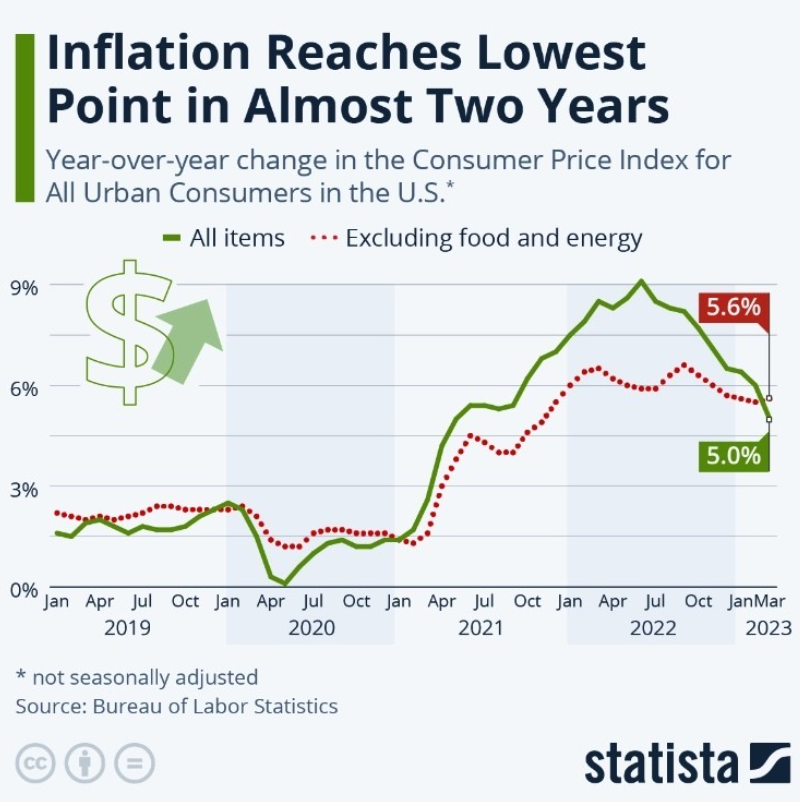

Inflation in the U.S. cooled to the lowest point in almost two years in March as year-over-year price increases reached 5 percent. The last time a reading this low happened was May 2021. Compared to February, prices rose by a seasonally adjusted 0.1 percent - less than the month-on-month increases recorded in February and January. While food prices overall remained unchanged from the previous month and food at home fell by 0.3 percent, energy prices decreased by as much as 3.5 percent over the same time period (and 6.4 percent year-over-year.) However, some of the drop was offset by rising prices for housing, up by 0.6 percent since February and more than 8 percent since the same time last year.

In part due to the rise in housing cost, the core consumer price index reading (excluding food and energy) is now higher than the reading for all items. Food and energy are considered the more volatile items in the CPI - they rose fastest when inflation took off at the end of 2021, but are now also cooling faster, especially energy. At a press conference last month, Fed chairman Jerome Powell had made remarks that many took as a hint that the central bank’s tightening cycle might soon be over. With the current reading, at least one more rate hike is expected next month. “The process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy,” the central bank leader was quoted as saying then.

When inflation started spiking in the spring/early summer of 2021, it was largely due to the so-called base effect, reversing the pandemic’s cooling effect on consumer prices a year earlier. At the onset of the pandemic, prices had taken a dive due to a sudden drop in consumer spending and fuel demand before slowly climbing back to their pre-pandemic trajectory over the summer and fall. Due to that initial dip in consumer prices, year-over-year comparisons were exaggerated for a while, but that is no longer the case since the end of 2021. As of this month, the year-over-year figure is for the first time compared with a post-invasion inflation reading, meaning that inflation rates from now on out will appear lower as they are compared to prices that had spiked in the aftermath of the start of the war in Ukraine.

*Data Journalist, Statista

**first published in: Weforum.org

By: N. Peter Kramer

By: N. Peter Kramer