by George Magnus*

Significant parts of the world are experiencing “dollar-phobia” – a dislike of the U.S. dollar and or a conviction it is past its sell-by date.

For a number of reasons though, dislodging (let alone supplanting) the U.S. dollar at the heart of the global financial system is not something that is likely to happen. Certainly not in the foreseeable future.

And if the dollar did indeed become unhinged, an orderly system would require a realistic substitute with comparable properties (notably with U.S. support and approval). However, we simply don’t have a credible candidate.

To assess the broader context, it is important to understand the unique role played by the U.S. dollar in the global commercial eco-system – and, by extension, why its status is so deeply entrenched (notwithstanding what its detractors allege).

Enter the Federal Reserve

An interesting contribution to this discussion surfaced late last year when a U.S. Federal Reserve paper was published, titled “Geopolitics and the U.S. Dollar’s Future as Reserve Currency.”

The paper advanced the argument that three-quarters of U.S. assets held by foreign governments are in the hands of U.S. allies (defined as states that have close military ties to the United States).

In a way, it is easy to see why this argument has appeal. After all, it is arguable that the last global reserve currency that fell from grace (the UK Sterling) did so as its geopolitical position was undermined. First by two world wars that left it indebted and a modest power relative to the United States. And second, by the embarrassment of the Suez Crisis in 1956 which triggered the rundown of the remaining significant holdings of Sterling in the Overseas Sterling Area.

As the Federal Reserve’s author underlines, as long as the United States’ alliance systems hold together, its geopolitical position will remain robust – and this at least will sustain the U.S. dollar’s position.

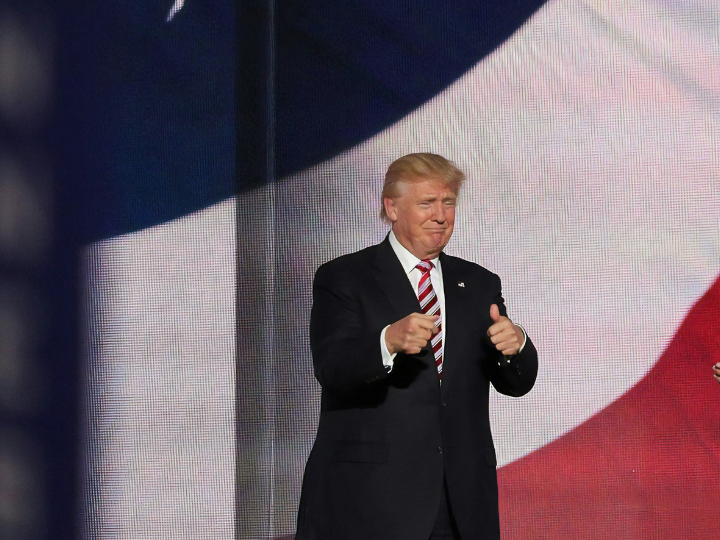

Perhaps so. However, if Washington were to turn sharply inward under a future administration (or to abandon Taiwan and other security pledges in Asia), there may well be cause for U.S. allies to wonder about the security of their U.S. dollar assets.

Fracturing the global financial system

Yet this would be tantamount to a fracture in the global monetary system, not a transition from a U.S. dollar system to another. The geopolitical argument for the U.S. dollar’s status is not without meaning. But it misses the point.

The United States’ geopolitical position in the world is surely associated with high holdings of U.S. dollar assets by countries that are formal or informal parts of the U.S. alliance system.

Yet, one could also say that a penchant among such countries for U.S. culture, commerce and cooperation is also associated with high holdings of U.S. dollar assets. Hard and soft power need not both be prevalent, but most people would argue the United States has them both.

Of course, association doesn’t necessarily mean causation or centrality. Still, it is remarkable that even the United States’ adversaries (or countries that do not want to choose sides between the United States and China) are as likely to be significant holders of U.S. dollar assets as those which are more clearly identified as allies.

The U.S. dollar’s global role

The reason for this is that the U.S. dollar plays a unique role in the world’s monetary system and global economy, unparalleled by the UK Sterling which was mostly linked to gold (or by the gold and silver systems that predated it).

It is uniquely determined, quite perversely, by the structure of the global balance of payments – and in particular by surplus countries like China, Saudi Arabia and Brazil (as well as other notables like Japan, South Korea and, in normal times, Germany.

These countries pursue macroeconomic policies that subdue domestic demand, sustain large savings that are reflected in balance of payments surpluses and then send these savings mostly to the only nation in the word with big enough capital markets, transparency, openness and trust to absorb them (i.e. the United States).

In other words, this has nothing to do with military alliances per se. It just so happens that the United States (as the pre-eminent economic and political power) features a system that is receptive to the flows that make the U.S. dollar what it is. And it has geopolitical clout.

The U.S. vs. China

Indeed, the geopolitical argument is that the U.S. dollar’s dominance in global finance is not as robust as it was 10 or 20 years ago in the light of China’s greater economic heft and assertive international relations behavior. This shift is also reflected in the struggle over influence in and for the alignment of the so-called “Global South” that is going on between the United States and other liberal leaning democracies on the one hand and China on the other.

The change in economic and commercial metrics is clear from the anomalous position of the U.S. dollar in the global economy. Although the United States accounts now for about 10% of world trade and a quarter of global GDP, the U.S. dollar accounts for about half of cross-border lending, international debt security issuance and trade invoicing.

In addition, it accounts for just under 60% of identified global currency reserves (though most likely higher when factoring in U.S. dollar assets accumulated by Chinese state banks as a proxy for the central bank), and U.S. dollars held in offshore financial centres and 90% of foreign exchange trading volume.

Less than meets the eye

Leading contenders of “proof” that this anomalous position cannot last, are the steady decline in the U.S. dollar’s share of identified global currency reserve and the assertion that the steady increase in Yuan invoicing of trade is a straw in the wind.

In both cases, though, there is less than meets the eye. The Bank for International Settlements has reported that most of the shift out of U.S. dollars in official reserves in recent years has been in favour of Australian and Canadian dollars, the South Korea Won and the Swedish krona (with the Yuan’s 2-3% share hardly moving).

Furthermore, even if Russia has had no alternative but to invoice and pay its bills more in Yuan, and other countries, such as Brazil, South Africa, Saudi Arabia and Argentina have said there is no reason why they shouldn’t follow suit, they are unlikely to cause a stir.

Countries that are commodity producers sell products that are U.S. dollar-linked. Saudi Arabia and some other oil producers peg their currencies to the U.S. dollar, and countries like Argentina are desperate for U.S. dollar reserves.

In any event, what matters is not how they pay their bills, but in what currency they accumulate their balances and investments – and that is still overwhelmingly in U.S. dollars.

What makes the U.S. what it is

The point at issue is not so much that United States’ geopolitical position is not important because it certainly is. Yet, the projection of its power and its alliance system are parts of what make the United States what it is – and the product of a still lively economy and commercial system whose share of global GDP has (if anything) been rising in the last 15 years to stand roughly where it was in 1990.

It is certainly true that dollar-phobia has gripped crypto enthusiasts, angsty inflation-istas, financial stability worriers and several countries. It is not only China and Russia (that are the United States’ adversaries) that do not wish to align with it and are opposed to U.S. sanctions and what they regard as Washington’s weaponization of finance.

Yet, changing the reserve currency is not like changing a suit or a dress to taste. Whether nations comprise part of the U.S. system of military alliances formally, or are adversaries such as China (or belong to the more promiscuous non-aligned group of countries in between), the U.S. dollar will remain pivotal – and systemically important for the foreseeable future.

The end of the dollar, if and when it happens, will be accompanied by an upending of the world’s trading and commercial system. You cannot change one without the other. And a lot of countries that are hostile to or ambivalent about the United States certainly don’t want that.

*independent economist and commentator, an associate at the China Centre, Oxford University and an adviser to some asset management companies

**first published in: Theglobalist.com

By: N. Peter Kramer

By: N. Peter Kramer