N. Peter Kramer’s Weekly Column

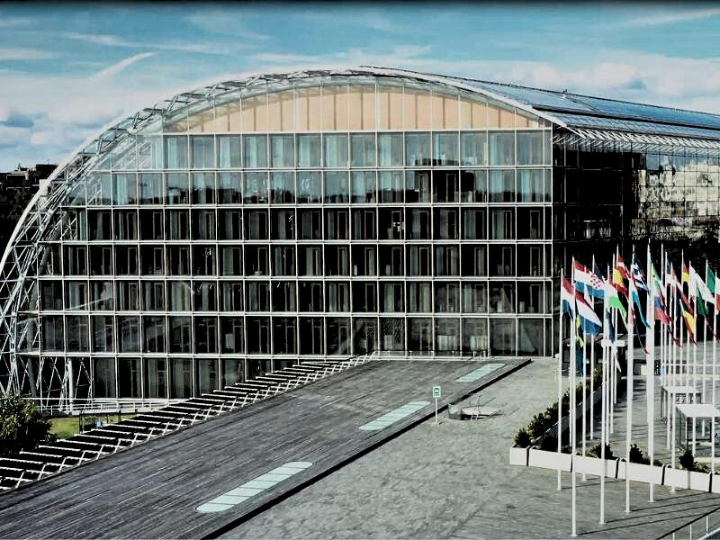

The European Investment Bank, world’s biggest multilateral lender by assets, phased out all fossil fuel investments from its €500bn loan book and branded itself ‘the climate bank’. But in a confidential message, seen by the Financial Times, one of the EIB directors warned of a ‘major reputational risk’ from changed EU sustainable reporting rules, which require a taxonomy classifying green investments.

The reporting reforms ask for the declaration of a ‘Green Asset Ratio’ (an EU standard to show the proportion of a bank’s assets considered to be climate-friendly) and would put the rate at ‘around 1 per cent’ compared with its current ratio based on EIB defined metrics which stands ‘above 50 per cent’. The EIB message continued with : ‘We should postpone the compliance timeline... telling (the European Commission) exactly what needs to be changed in the regulations for the taxonomy to be workable for a use of proceeds, which it is not at present’.

The EIB’s comments echo growing concern from EU governments and industry bodies about the complexity and burden of the EU’s sustainable finance rule book, which forms a major part of the EU’s Green Deal climate law. In a letter to the European Commission President Ursula von der Leyen, also seen by the FT, presidents of six development banks, including Nadia Calvino of the EIB, said that they were ‘particularly concerned that additional data collection requirements we would need to impose on clients, especially SME’s, will lead to an excessive reporting burden’.

It is clear that these new excessive Green Deal rules could seriously discourage the financing of climate action by lenders such as the EIB.