by

Michael A. Witt**

There is a simple truth in international business: All else being equal, the more similar the host country abroad to the home country of a firm, the more likely is success. It is a lot easier, for instance, for a Spanish firm to do well in Portugal than in Switzerland.

For firms and internationally active managers, this places a premium on knowing just how different markets abroad are. In addition, it is helpful to know what drives these differences so suitable adjustment strategies can be devised and implemented.

Exploring these questions has been a central theme of a rich and growing literature about “national business systems” and “varieties of capitalism”. In our paper, “Mapping the business systems of 61 major economies”, my five co-authors* and I provide the currently most comprehensive overview and categorisation of differences in the ways of doing business.

Spanning all continents save Antarctica, our sample comprises 61 economies, equivalent to 93.5 percent of the world GDP. Based on statistics and expert insights, we assessed these economies on eight dimensions that research had previously shown to be key: education and skill formation, employment relations, finance, interfirm relations, internal dynamics, ownership and governance, social capital, and the role of the state.

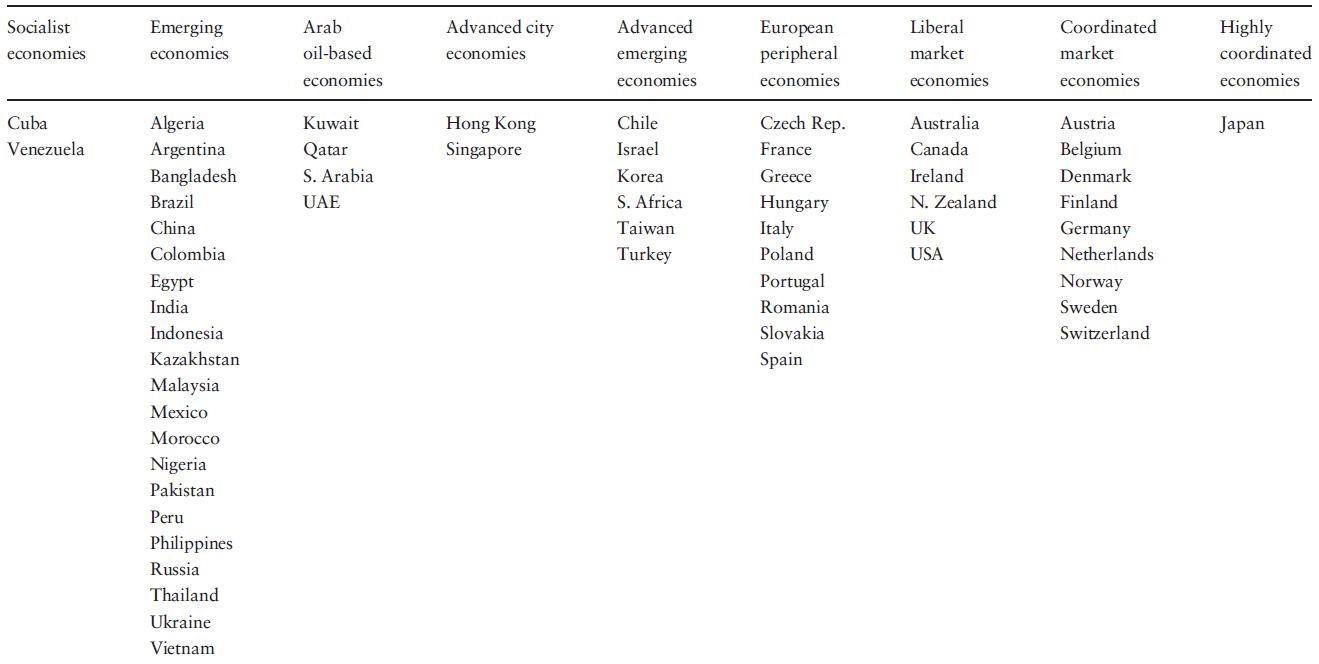

Using cluster analysis, we found nine main types of business systems in the world, listed below. No progression from left to right is implied, the table merely replicates the order in which the cluster analysis presented the groups.

Here is a brief overview of these clusters, highlighting a few selected points from the full discussion in our paper:

1. Socialist Economies: Comprising Cuba and Venezuela, this cluster features very low inward foreign direct investment, as well as very weak union rights, investor protection, and rule of law.

2. Emerging Economies: This is the largest cluster, with 21 geographically heterogeneous countries, from Argentina to the Philippines. They notably share relatively low levels of per-capita GDP, with oil and gas-rich Russia as an outlier.

3. Arab Oil-based Economies: While attempting to diversify, Kuwait, Qatar, Saudi Arabia and the United Arab Emirates still mostly rely on oil production and exports. There are important roles for family and state ownership.

4. Advanced City Economies: Hong Kong and Singapore are the only two city-based economies of sufficient size to be included in our sample. Both are trade-dependent hub economies with high levels of economic freedom and government effectiveness.

5. Advanced Emerging Economies: Despite their geographical distance, Chile, Israel, Korea, South Africa, Taiwan and Turkey have many commonalities, including decent levels of general education, medium-length employment tenures, as well as on-the-job and private vocational training.

6. European Peripheral Economies: These business systems include the Southern European economies as well as the Central European economies west of Ukraine. They have long-term average employment tenures, average levels of investor protection and medium to high rule of law.

7. Liberal Market Economies: In this cluster, which comprises the United States, Canada, the United Kingdom, Ireland, Australia and New Zealand, finance is market-driven and decision making, top-down. Employment tends to be short-term with an emphasis on transferable skills so people can easily change jobs.

8. Coordinated Market Economies: This group of nine European countries features bank-based finance and long-term employment, among other characteristics. Internal decision making tends to be consensual, and companies cooperate extensively across firm boundaries.

9. Highly Coordinated Economies: While being close to the coordinated market economies, Japan stands out as a cluster of one. The reason for this is that arrangements between management and labour, such as wage negotiations, mostly happen at the firm level, leaving national concertation prominent in Coordinated Market Economies with a much smaller role.

A score measuring the relative challenge of doing business in another economy

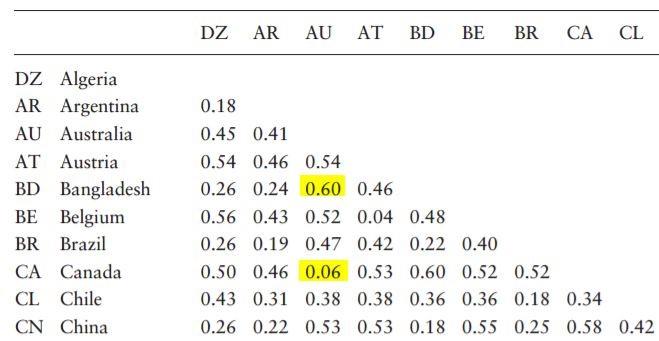

While the main goal of our paper was to contribute to theory, it has important practical implications. Our eight-dimension analysis of 61 economies yielded a matrix of scores – so-called “institutional distances” – quantifying just how differently businesses are run, on aggregate, from one country to the next.

In this matrix, the higher the score (max. 1 and min. 0), the larger the aggregate difference between a given pair of countries. To illustrate, the table below represents a small sample of the full 60x61 matrix.

Taking Australia (AU) and the figures highlighted in the third column as an example, we can see that Australia’s ways of doing business are most dissimilar from those of Bangladesh (0.60) and very similar to those of Canada (0.06).

The complete table can be found on pp. 11-16 of our paper. It enables firms and executives from any of the 61 economies covered to assess the magnitude of the challenges of operating in any of the other 60 economies – for instance, France is most similar to Italy, Switzerland to Denmark, and the United States to Australia. The text of our paper can then be used to gain a fuller understanding of what drives these differences.

We believe that these scores can, and should, inform international investment decisions. While many factors drive investments, success in operating abroad is often contingent on how well a firm can interface with, and selectively adapt to, the foreign way of doing business. The international business literature has shown that the greatest challenge for doing business abroad is what is known as “liability of foreignness” – not knowing how to run the business in the host country. The matrix provides a heuristic for the magnitude of the challenge.

The scores should similarly be useful for executives preparing themselves for international assignments. Savvy executives will, of course, over time pick up on the differences expressed in the institutional distance scores and the text of our paper. However, our findings should help accelerate this process and increase chances of success.

* The paper’s co-authors are: Luiz Ricardo Kabbach de Castro (Universidade de São Paulo), Kenneth M. Amaeshi (University of Edinburgh), Sami Mahroum (INSEAD), Dorothee Bohle (European University Institute) and Lawrence Saez (School of Oriental and African Studies).

**Michael A. Witt is an Affiliate Professor of Strategy and International Business. He is the programme director of International Management in Asia Pacific, one of INSEAD’s open-enrolment Executive Development Programmes. He teaches international business – i.e., how to get from country A to country B without getting a bloody nose. He holds a Ph.D. from Harvard University and an A.B. from Stanford University.

***First published in knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer