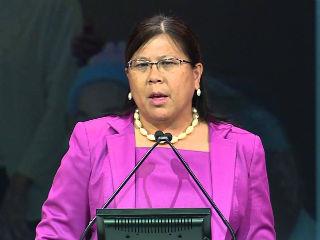

Climate Action caught up with California State Controller Betty T. Yee on scaling up low carbon investment and her participation in the Sustainable Investment Forum

Many companies and investors came out of the 2015 Paris climate talks with renewed vigor in those efforts, yet today we face additional challenges. The president’s decision to pull out of the Paris Agreement significantly reduces the world’s chances of stemming the effects of climate change. It is more important than ever to ensure that investors continue to advocate for corporate sustainability reporting because if we cannot measure it, then we cannot engage. By encouraging the adoption of voluntary standards under the Sustainability Accounting Standards Board, corporations will be able to measure their use of carbon and overall sustainability. This will provide investment funds, including CalPERS and CalSTRS, with an important tool to identify corporations lacking a reasonable sustainability plan that addresses long-term risks.

Firstly, could you please introduce yourself and tell us a bit more about what you do?

As the chief fiscal officer of California, the sixth largest economy in the world, I am responsible for accountability and disbursement of the state’s financial resources. I also independently audit government agencies that spend state funds, safeguard many types of property until claimed by the rightful owners, and administer the payroll system for state government. I serve on dozens of state boards and commissions with authority ranging from land management to crime victim compensation.

I serve on the boards for the nation’s two largest public pension funds, CalPERS and CalSTRS, with a combined portfolio of over $500 billion. As a board member, I am focused on delivering promised retirement and health benefits for members while keeping the pension systems on sound fiscal footing and advancing environmental, social and governance goals.

I also serve on the board of directors for Ceres, a nonprofit organization working to mobilize many of the world’s largest investors to advance global sustainability and take stronger action on climate change.

What are some of the key challenges to scaling up low carbon investment in California?

As long-term institutional investors, CalPERS and CalSTRS recognize investment decisions that disregard the sustainability of our natural resources or the health of our planet will not generate lasting returns. However, we also have a fiduciary duty to our members to ensure the benefits they earned are fully paid. We must analyze sustainable investments with the same stringent criteria we apply to other investments.

Given the size of the CalPERS and CalSTRS portfolios ($310 billion and $210 billion respectively), the proposed investments must meet a specific size threshold to be economical. We also have relatively higher return targets for our portfolios compared to other investors who are competing to provide financing for these projects. Finally, the risk tolerance factors tend to favor developed projects instead of providing seed funding.

Given these constraints, the funds have addressed these challenges in many ways. Last year, CalSTRS announced a $2.5 billion investment in a low-carbon index fund, with $2 billion invested to date. CalPERS recently purchased an ownership stake in Desert Sunlight, which operates two solar power plants in the California desert providing 550 megawatts for sale to California utility companies. Both pension funds focus on energy efficiency efforts within their real estate portfolios, leading to higher returns and lower carbon emissions. CalSTRS and CalPERS also invest in start-up firms working on innovative sustainable products via external private equity managers. The recent extension of California’s cap-and-trade program will help to drive progress in this area as consumers begin to demand more economical low-carbon products.

After the recent announcement in the US, you have declared that “shareholder engagement on companies’ sustainability goals” would need to redouble in order “to ensure cleaner environment and stable economic future”. Could you expand on this for us?

Many companies and investors came out of the 2015 Paris climate talks with renewed vigor in those efforts, yet today we face additional challenges. The president’s decision to pull out of the Paris Agreement significantly reduces the world’s chances of stemming the effects of climate change. It is more important than ever to ensure that investors continue to advocate for corporate sustainability reporting because if we cannot measure it, then we cannot engage. By encouraging the adoption of voluntary standards under the Sustainability Accounting Standards Board, corporations will be able to measure their use of carbon and overall sustainability. This will provide investment funds, including CalPERS and CalSTRS, with an important tool to identify corporations lacking a reasonable sustainability plan that addresses long-term risks.

CalPERS’ carbon footprint project analyzed over 11,000 companies in its global equity portfolio and found that 100 contributed to more than 50 percent of its portfolio’s carbon emissions. This targeted list will help CalPERS to shape its engagement program with top carbon emitters. Since most investors’ portfolios include many of the same companies, it may also provide other investors an assertive starting point to launch crucial engagements.

You will be speaking at the Sustainable Investment Forum 2017. Could you give us a brief outline of what you will be discussing?

I look forward to highlighting the multifaceted efforts of CalPERS, CalSTRS, and Ceres to proactively pursue low-carbon investments and lead engagement with companies to push for positive change from within. While institutional investors face increasing divestment pressures, I will discuss why in most cases I believe the better alternative is engagement and collaboration. As we depend less and less on fossil fuels, progress towards sustainability reporting and robust low-carbon investments is advancing rapidly. More companies are recognizing these opportunities. The transition to renewable energy will accelerate and spur incentives, innovation, and further investments.

*Controller Yee will be speaking at the Forum on the panel on Strong Leadership for Accelerated Low Carbon Investment.

By: N. Peter Kramer

By: N. Peter Kramer