by Andrea Willige*

-Retirement lengths vary by country.

-There are now more people over the age of 65 than there are under the age of five.

-The World Economic Forum says pension savings must be incentivized to ensure better retirement outcomes.

For the first time, there are now more people over the age of 65 than there are under the age of five, a World Economic Forum report has found.

As a result, there are fewer young people to support the growing number of pensioners around the world, requiring many people to retiring later than they planned

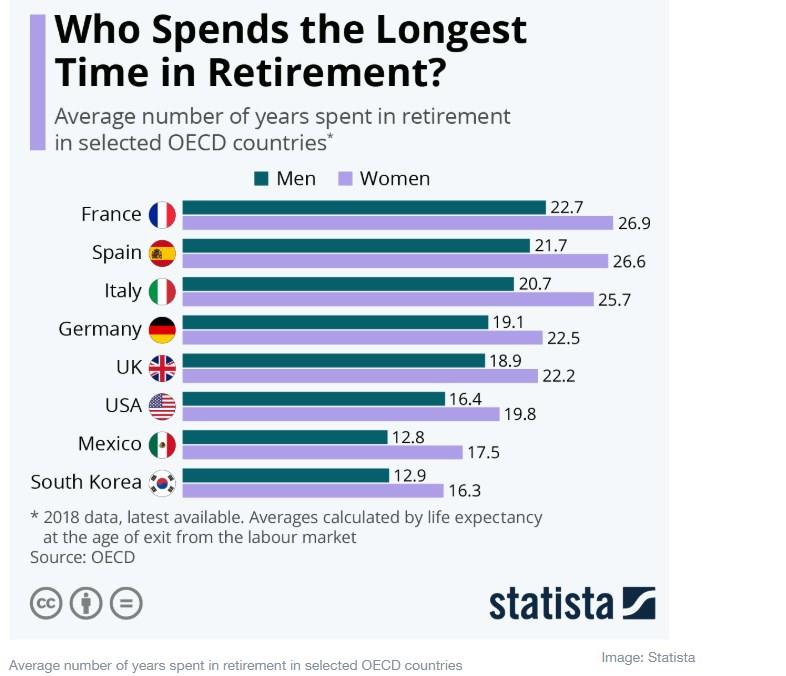

The average expected length for retirement in OECD countries has remained mostly flat in recent years (staying put at around 20 years for women and 18 years for men). Still, lengths can vary widely thanks to factors such as a country’s retirement age or life expectancy.

Here are a selection of how retirement lengths stack up throughout the world.

25 years or more

New OECD statistics show that French pensioners spend the longest time in retirement out of all OECD countries: nearly 27 years for women, and just under 23 for men.

Spain, Austria, Belgium and Italy closely follow France. Female retirees in these countries enjoy retirements of 25 years or more.

20 years or less

South Koreans can expect around 10 fewer years of retirement than their French counterparts, with an average of around 16 years for women and 13 for men. Only Mexican men can expect a shorter retirement period than their Korean counterparts.

The typical retirement age in Korea is also higher: around 68 years for men and 67 for women. Korea is also expected to have one of the oldest populations among OECD countries. Around half of these workers will be 50 and older by 2050.

A widening gap

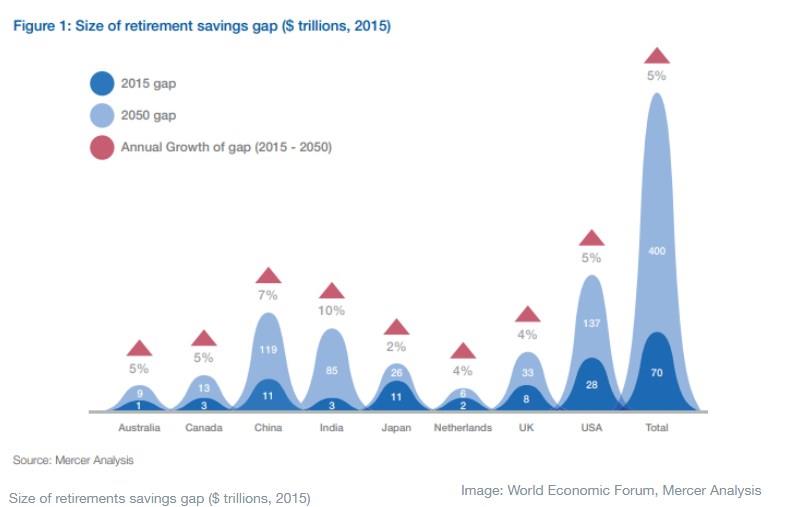

Though many will work longer than they plan, longer retirements can’t always bridge retirement savings gaps. Among nations with large populations or sizable retirement savings markets, the gap stood at $70 trillion in 2015 and is poised to grow.

Unless key measures are taken that gap will widen. According to the Forum’s Investing in (and for) our Future 2019 report, that number is forecast to reach $400 trillion by 2050.

To bridge this gap across the OECD, personal pension savings will be key. The Forum’s report stresses that policy-makers, employers and asset managers need to explore incentivizing contributions and optimize how these monies are invested.

In some countries, such as Singapore, this thinking has led to the creation of special accounts for housing or health care. In other countries, like the UK, age requirements for products such as annuities have been lifted, promoting savings.

These and other creative savings approaches will be key in helping people achieve the best outcomes as retirements shorten and life expectancy lengthens.

*Senior Writer, Formative Content

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer