Sustainable Investment Forum

The Sustainable Investment Forum – the largest finance-focused event took place during New York Climate Week, was back for its second edition on 19 September 2017

Organised in partnership with the UNEP Finance Initiative (UNEP-FI) and building on the success of the 2016 edition, the Forum welcomed over 350 attendees representing asset owners and managers, commercial banks, development banks, private venture capital, technology developers, mayors and national policy makers all looking to drive innovation and collaboration.

Key topics that covered include decarbonising investment portfolios, reducing risk, maximising private and public benefit and innovative finance tools and technologies.

More specifically among the key themes were:

-Corporate and regional level leadership in sustainable investment

-Increasing low carbon investment and expanding green portfolios

-Need for global standards and regulation

-New sustainable finance tools

-Leveraging technology for a risk-free financial system

-Investment to transform small and large scale energy infrastructure

-New markets for sustainable development and landscape management

Public and private finance leaders discussed low carbon investment in New York

On Tuesday 19 September, Climate Action, in official partnership with UNEP Finance Initiative, held the second Sustainable Investment Forum 2017 at the Crowne Plaza Hotel Times Square in New York during Climate Week NYC

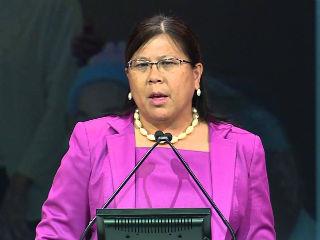

Interview with California State Controller Betty T. Yee

Climate Action caught up with California State Controller Betty T. Yee on scaling up low carbon investment and her participation in the Sustainable Investment Forum

Interview with Philippe Desfossés, CEO of ERAFP and Vice Chair of IIGCC

Climate Action caught up with Philippe Desfossés, Chief Executive Officer of ERAFP and Vice Chair of IIGCC, on scaling up low carbon investment and his participation in the Sustainable Investment Forum

Sustainable Investment Forum: Financing Innovation for a Low Carbon Future

The Sustainable Investment Forum – the largest finance-focused event taking place during New York Climate Week- is back for its second edition on 19 September 2017

Interview with Raymond Johansen, Governing Mayor of Oslo

Climate Action caught up with Raymond Johansen, Governing Mayor of Oslo, Norway, on scaling up low carbon investment and his participation in the Sustainable Investment Forum 2017

By: N. Peter Kramer

By: N. Peter Kramer